Shasta County Market Update - May 2022

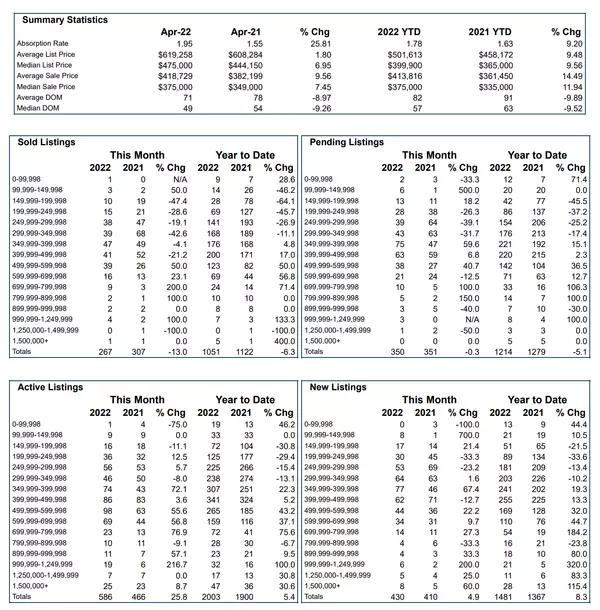

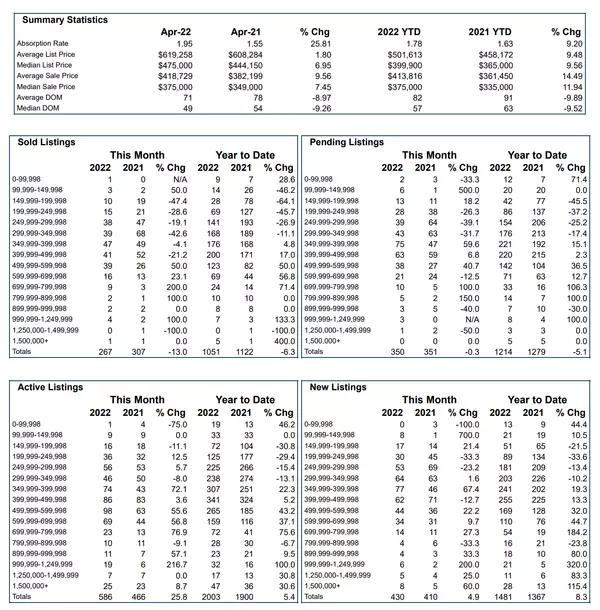

Click Here to watch Josh's video blog for the month of May. From the Desk Of Josh Barker Hello everyone, I hope your spring is off to a great start and you are all enjoying the beauty of Shasta County in this season. Like the temperatures as we approach warmer months, we are seeing a rise in new construction in the area. Mortgage rates have risen and we're seeing a slight slow down in home sales. This month we will discuss some of the hottest topics trending now. If you have any additional questions, please feel free to respond to this email or contact our office at 530-222-3800. Enjoy the beginning of spring! Josh Barker MARKET UPDATE FOR MAY 2022 Home Sales Home sales for the month of April finished at 267 closings down 13% compared to the 307 closing in the month of April last year. The slow down in home sales compared to last year is largely due to rising interest rates and the transition from pandemic related purchases to a more traditional market. Home Listings Home listings in the month of April finished at 586 properties for sales up 25% compared to the 466 properties for sale in April of last year. The slow steady increase in home inventory is projected to continue as more homeowners make the decision to move forward with plans that were on hold during the pandemic. Interest Rates 30 year mortgage interest rates (currently 5.5%) have climbed steadily in recent months as the federal reserve raised interest rates while at the same time reducing the amount of mortgage backed securities they purchase. These two Federal Reserve policy actions are projected to continue as the Fed continues to take actions to reduce overall inflation in the economy. The Fed is expected to increase interest rates again this month by approximately .5% which could increase the 30 year mortgage rate to an average of 6% by the end of May. For every 1% the 30 year mortgage interest rate increases, the average borrower's purchasing power is reduced by approximately 10%. Rental Market The rental market in Shasta County continues to remain extremely competitive with rental rates rising on nearly a monthly basis. In the year 2020 the average 3 bedroom home in Redding averaged $1,394 per month. In 2022 the average 3 bedroom home in Redding averages $1,783 per month, an increase of approximately 22% according to RentData.org. Home Price Expectations After last year's large home price appreciation averaging 18% according to Zillow, this year's expectations are expected to be far less. The median sales price for a home for a home in the month of April averaged $375,000 up 7.5% compared to the median sales price of $349,000 in April of last year. Home price appreciation is beginning to cool off after a massive run during the first half of 2021 and is projected by experts to climb by an average of 6% in 2022. The two largest contributing factors to pay special attention to are rising interest rates and the overall home inventory relative to demand. These two factors will have the largest impact on future home prices. New Construction After what many would consider to be a major new construction boom in Shasta County, things may be changing. In July 2018 our local market experienced a massive fire destroying over 1,600 buildings and damaging many more. Several months later, Paradise California, a small community approximately 1.5 hours south of Redding had a massive fire destroying nearly 19,000 homes. In 2019 the city of Redding received a massive hail storm damaging many roofs on Redding's east side. Collectively, these events triggered a massive construction boom that was eventually pushed into hyper drive as a result of the housing boom related to the Pandemic. To learn more about what changes may be coming to the construction industry stay tuned for our next podcast in the middle of this Month. We will be diving into the topic and you will not want to miss it! Below are a collection of slides that correlate with many of the topics discussed in this mid-year review. If you have any additional questions regarding this market update or have additional real estate questions please feel free to respond to this email or contact our office at 530-222-3800 Learn more about Josh Barkers 5 proven steps to selling your home by visiting Selling Your Home Learn more about Josh Barker's proven ideal investment formula by visiting Buying A Home Check the average value for your home instantly by visiting our Home Value page Make it a great May! Josh Barker P.S. You can view all of our past real estate market updates by visitinghttps://joshbarker.chime.me/blog

Shasta County Market Update - April 2022

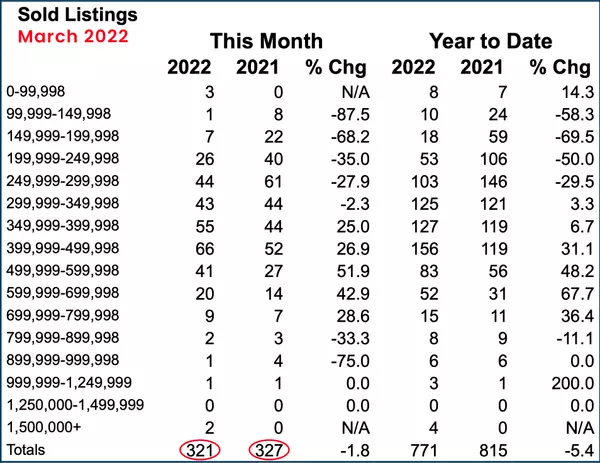

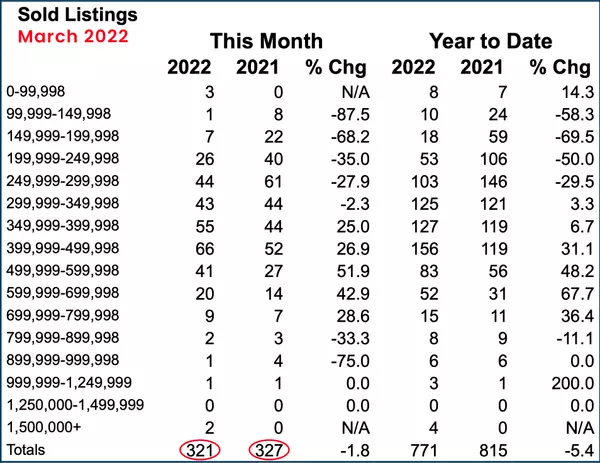

Click Here to watch Josh's video blog for the month of April. From the Desk Of Josh Barker Hello everyone, As the first quarter of 2022 comes to an end, we certainly see changes on the horizon. Listing inventory is trending up, sales volumes are down slightly and interest rates are rising. It appears that the federal reserve is focused on attacking inflation. In the coming months we could expect to see interest rates continue to rise in an attempt to slow down the housing market and curb rapid inflation. In the second quarter we could expect to see higher housing inventories particularly in the 500k and above price ranges. The below 500k price ranges will likely continue to experience strong buyer demand and relatively tight supply. This month we will discuss some of the hottest topics trending now. If you have any additional questions, please feel free to respond to this email or contact our office at 530-222-3800. Enjoy the beginning of spring! Josh Barker MARKET UPDATE FOR APRIL 2022 Home Sales Home sales in March ended at 325 down slightly compared to March of last year when homes sales finished at 327. The good news is that home sales volume continued to remain strong despite higher interest rates. The not so good news is that many of the home closings in March were based on home buyers that had already locked in interest rates prior to the federal reserve increases. Home sales in April could be a good indicator of the impact of higher interest rates. If home sales continue to remain strong it should be a testament of the impact of overall low home inventory relative to demand. Home Listings New home listings in the month of March finished at 431 new listings up from the 381 new listings in the month of March of last year a 12% increase. The overall active home inventory is also trending up averaging 527 properties for sale up 15% compared to last year. The most noticeable increase in home inventory is focused around the above 500k price range where inventories are up over 50% compared to last year. Interest Rates Mortgage interest rates have risen significantly over the past several months. Currently rates are averaging 4.9% up from the 2.9% available towards the end of last year. For every 1% that the interest rate increases, the borrower's purchasing power is reduced by up to 10%. As mortgage rates increase, there will likely be an impact on home sales in the 500k-700k price first. The largest factor is that home sales volumes begin to slow down significantly in these price ranges with fewer buyers to pull from in higher price ranges. The lower end of the market will likely continue to see high demand as buyers that were qualified at higher price ranges and at lower interest rates begin to purchase homes at lower price ranges with higher interest rates. Unfortunately, we will likely see "would be" previous home buyers in the lowest price ranges priced out of the market altogether as the recent mortgage rate increases push the affordability of homes out of reach. Home Appreciation Home appreciation in the year 2022 has been forecasted by experts to reach 7.5% on average and appears to already be trending this way. Assuming mortgage rates continue to rise as projected, home appreciation may level off by early summer. The largest factor in these appreciation projections will likely be focused on the housing supply. If home inventory grows quickly and mortgage interest rates rise quickly we could expect home prices to level off accordingly. Rental Market The rental market continues to remain exceptionally strong. Vacancy rates are already stubbornly low, and with rising mortgage rates the rental market will likely grow even tighter. The benefits of home ownership continue to overshadow the prospect of renting. Although renting a home provides maximum flexibility, the down side of housing inflation and the cost of living due to higher rents is a challenge. Homeownership is not the best option for everyone but should be considered strongly when planning for the future. Below are a collection of slides that correlate with many of the topics discussed in this mid-year review. If you have any additional questions regarding this market update or have additional real estate questions please feel free to respond to this email or contact our office at 530-222-3800 Learn more about Josh Barkers 5 proven steps to selling your home by visiting Your home sold Learn more about Josh Barker's proven ideal investment formula by visiting Buying A Home Check the average value for your home instantly by visiting Home Value Make it a great April! Josh Barker P.S. You can view all of our past real estate market updates by visitingBlogs

Shasta County Market Update - December 2021

Click Here to watch Josh's video blog for the month of December. From the Desk Of Josh Barker First and foremost I hope that all of you are well and enjoying time with friends and family this Holiday season. The surrounding mountains are snow capped and the colors in the trees are an amazing treat for all of us here in the North State. For those of you that are out of town reading this newsletter, come and visit us in the North State soon! I would also like to take a moment and thank all of you for your continued support and feedback regarding our monthly newsletter. Our viewership has just surpassed 20,000 and our commitment to bringing the local real estate news to all of you has never been higher. This month we will briefly touch on several of the hottest topics trending now in our local market. If you have any questions, please do not hesitate to reach out by responding to this email or contact us at the office at 530-222-3800. Happy Holidays! MARKET UPDATE FOR DECEMBER 2021 Home Sales Home sales in the month of November finished at 255 closings similar to last month, and slightly higher than the 259 reported in November of last year. The reduced volume of home sales in the local market over the past several months is leading many to believe that the market is transforming into a more normal and balanced market. Listing Inventory The number of active listings for sale in the local market is currently hovering at approximately 635 listings for sale, down slightly over last month which reflects the normal seasonal change. Although the inventory remains lower than last year, it has continued to trend up since the lowest point in March of this year when inventory hovered around 465 properties for sale. The recent inventory increases are a welcomed addition to the already depleted housing supply. Buyer Demand The number of buyers shopping for homes has decreased in recent months. Earlier this year it was common to see 10-15 offers on a single property. Today, these same types of properties may only receive 1-3 offers. Although the home is sold in either case, this recent trend is revealing that the market is beginning to cool off. We expect to see clean and well priced homes continue to sell quickly, but the days of "testing the market" are numbered if this trend continues. Rental Market The rental market continues to perform exceedingly well. Many property management companies are sitting on low inventories and vacancy rates are extremely low. The cost to rent has continued to climb in recent months and this trend is expected to continue as properties become vacant and are re-rented. If you or anyone you know is planning to rent, start your search early. The low rental inventory could prove to be more challenging than expected. Home Price Appreciation The average price for a home jumped an eye catching 17% over the past year in the Shasta County market. Local homeowners are sitting on more equity today than at any other time over the past 10 years. The rate of appreciation is beginning to cool off and most home price expectation surveys are projecting a 5% appreciation in 2022, assuming there are no major economic disruptions or interest rate increases. Mortgage Rates Mortgage rates have trended up slightly over recent months and are currently averaging 3.25% for a 30 year fixed mortgage. The Federal Reserve has recently stated they intend to raise rates half of one percent in the next year which could translate into a 3.75% interest rate for a 30 year mortgage by the third quarter of next year. Keep in mind, for every one percent that the interest rate increases, the borrower's purchasing power is reduced by approximately ten percent. Below are a collection of slides that correlate with many of the topics discussed in this mid-year review. Please feel free to contact our office with any additional questions you may have. 530-222-3800 Learn more about Josh Barkers 5 proven steps to selling your home by visiting joshbarker.chime.me/your-home-sold Learn more about Josh Barker's proven ideal investment formula by visiting joshbarker.chime.me/buying-a-home Check the average value for your home instantly by visiting joshbarker.chime.me/home-value Make it a great December! Josh Barker P.S. You can view all of our past real estate market updates by visitingjoshbarker.chime.me/blog

Recent Posts