Josh Baker Real Estate Podcast #6

🏠💰Home Value Tool➔

Frequently Asked Questions

How does balloon payment work?

Balloon payments are established dates on which the remaining balance of the loan is due in full.

Are balloon payments a good idea?

Balloon payments should be carefully considered and are not the ideal loan instrument for everyone.

Are balloon payments a good idea?

Balloon payments should be carefully considered and are not the ideal loan instrument for everyone.

How fast do mortgage interest rates change?

Mortgage interest rates change on nearly a daily basis.

What is the single most significant factor affecting the real estate market?

Availability of financing, minimum credit score requirements, and interest rates have the largest impact on the real estate market.

What happens when interest rates hike?

For every one percent the 30-year mortgage interest rate increases, the borrower's purchasing power is reduced by up to ten percent.

How does an interest rate hike affect inflation?

Rising interest rates have a negative impact on consumer demand. Over time, reduced demand can reduce inflation.

What factors affect interest rates?

Investor demand for bonds on the open market has an impact on interest rates.

Who decides the price of a home?

Property owners typically set the list price for a home. Both buyers and sellers collectively determine the final selling price for a home.

How do they determine the value of your home?

The value of a home is typically determined by reviewing national mortgage trends, local sales data, and comparable property sales over the previous 3-6 months.

Transcription*

The transcription is auto-generated by a program and may not be accurate to the conversation. In order to ensure you get all the information from the video properly, you must watch the video.

Joey: Let the games begin. It's Joey Gartin here with Josh Barker.

Josh: Hello, Joey. Thank you.

Joey: So there's been a lot going on this last week. Actually, it's been over the last few weeks, the same topics keep bubbling up because they are like the big rocks. I always as that term used, you hear the rocks, hear the pebbles, right?

Josh: Yeah.

Joey: Well, the rocks that are big are still big and potentially getting bigger, like interest rates are kind of moving very, very fast, and that is a major contributor to our market, whether it's up or down. And interest rates, unless you've been on an island somewhere, you probably know the interest rates have been going up very steadily.

Josh: They have, I think right now, we're at 5.5% on the average 30-year fixed mortgage, and that's up from about 2.9% in the fall of last year, so we're up to over 2% right now. That's a lot.

Joey: It's a lot. It's huge.

Josh: That's significant. Yep.

Joey: And like we said, I think we were talking about it last summertime, the time before we talked about it, that impacts the lower portion of the market much more than it does the higher, and that's your first-time buyers, that's your investors.

Josh: Yep.

Joey: Right?

Josh: Yeah.

Joey: So those are two major buyers in this market...

Josh: Well, I actually know what just happened just recently was that the interest rate on non-owner occupied, so let's say I was an owner who wanted to buy a rental, but the rates now for non-owner occupied are significantly higher than they are for an owner-occupied. So Fannie and Freddie, who purchases these mortgages, typically after they're funded, basically came out and said, "No, we're not buying them, we want the rates higher." And it's in an attempt, I think, to try to push more attention towards homeownership, and so I think that's one of the reasons they made that decision, but what used to be a pretty low, an inexpensive rate for non-owner occupied, that's gone up a lot. So if anybody who's listening to this or watching this and thinks that the rates on an investment property are the same as on the owner-occupied, that is not the case right now.

Joey: They've always been a little bit higher, just like a tiny... Your primary residence, you always get a little bit better, but...

Josh: No, this is significantly higher.

Joey: This is significant?

Josh: Yeah, and without quoting it, I would just say it would be shocking to you and you'd probably wanna check with the mortgage lender.

Joey: So that's gonna slow down. I get that kind of concept of like, "Oh, we wanna help first-time buyers more." And it's like, "Okay, well, then why not keep those interest rates a little... If you can do something with that program to where you keep first-time buyers... "

Josh: Good idea. They disincentivize somebody from using a mortgage to buy an investment property because the rates are higher for it, right?

Joey: Yeah.

Josh: So they essentially, they're doing that. They're trying to reduce the competition for what could have been an owner-occupied purchase. I'm assuming that's what they're doing, 'cause that's certainly what their net effect is on the market, is as you have less investment activity taking place as a result of those interest rates going up because it has an impact on the return on investment. So the higher the rate, the lower the return. The lower the return, the harder it is for an investor to wanna make that purchase. So it's probably working if that's what their goal was.

Joey: Now, we talked about before that one of the big differences between this market and the market that we saw in the early 2000s that collapsed was that we didn't have a huge investment before. I think you were saying it was around 10%, which is very small.

Josh: Oh yeah, no, on the last market update that we sent out to everybody, we actually talked about that in length, is that if you look at what the market was in 2003, '04, '05, 2003, 2004, 2005, and then... The peak of the market was in 2006, and then it started to show some problems, and then it started to decline pretty quickly. Understand, back then we had buyers that would walk into our office that were qualified in a 30-year fixed mortgage, who were gonna be buying a subdivision for, let's say, $300,000. But if they went to a non or to a stated income loan or a variable interest rate or a negative amortization or interest-only loan, now they can buy up to $500,000 for that home, right?

Joey: Yeah.

Josh: And so it's a completely different property, same monthly payment. And that's what was happening in 2004 and '05. It's a big reason why we had the market crash like it did, is because we had a lot of people purchasing way outside of what they really should be purchasing because those all had balloon payments to 'em. Within a few years, you were gonna have to pay the higher payment amount. Whereas today, we don't have purchases like that. Those loans are not available, they're illegal. The Dodd-Frank bill that was written years ago to clean that up, eliminated those types of transactions from being, even being available to the general public. So we don't have that today. Back then, 2005 and '06, you had the 620 and below credit score was a significant portion of the purchasing market.

Joey: Wow.

Josh: Where today, it's a very small portion of the market. So those things are different. And then back then, I think it was 40%-50% of all purchases at the peak of the market back then in 2005, '06, it was like 40%, 50% of it was speculation.

Joey: Wow.

Josh: Yeah. Whereas today, like I said, it's less than 10%. So we have a lot of good things about the market right now in terms of its stability of it. I'm not saying that we're not gonna slow down, I'm not saying that we won't see something... We might even give back some value if rates were to go crazy, but in terms of the stability of the loan itself, people buying homes today are strong credit, good down payments, sourced incomes, and sourced employment. The stability of the market now is way better than it was 15 years ago.

Joey: Yeah. So that, I mean 40%-50% speculation. I do remember people were pulling out equity to buy the second home, 30... I don't hear that very often at all. In fact, I don't hear that at all.

Josh: Yeah, I haven't heard it much either. Yeah, I haven't heard it a lot. If I have, I think I've heard 'em of paying down student loans and paying off other debts and not necessarily what they were doing back in '04, '05, '06, is that they were taking that money out and then go buy the next rental with it.

Joey: Exactly.

Josh: And we don't see that happening at all in any mentionable level today. Yeah.

Joey: So interest rates are going up, that's gonna slow the market down. Of course, we're coming out to one of the hottest markets of all time.

Josh: Yes.

Joey: Last summer was, some of the sales... But I still see, I was about to say that some of the sales I saw were very, very high, but I was looking at some of the listings and they're still even higher.

Josh: Yes.

Joey: So when you say, I feel like there's gonna be a little bit of course correction. And I've never... I've heard people, especially on social media, they'll get mad at the real estate agents when they see a home listed for a certain price and say, "Hey look, their job is to get their client the absolute most that they can."

Josh: Right.

Joey: Now, the home price is determined by the marketplace. It's not determined by the agent. That's why an agent that undervalues the house, "Oh, hey, we got three offers at 20-30 grand over." It's like, "Well, clearly you didn't assess properly," or "Well, it's been listed for 90 days and we haven't got an offer." Again, you assessed improperly in the other direction. So it's not the agent. But I do see some listings that I'm like, "Man, how did that pitch meeting go?"

Josh: Somebody got pitched, whether the buyer pitched the agent or the agent pitched the seller or the seller pitched the agent.

Joey: I'm thinking retail plus 30%, blue-chip player like myself deserves a little something extra, like $10,000 cash in a gym bag.

Josh: Everybody wants more. Well, and to your point, I think that anybody that's listening to this and owns a home or watches it, I think they would agree that they... And they know this too. Everybody feels like their home is worth more. And you want it to be. And then when you get to the reality of it, I think that I always kinda feel like sellers are ultimately the ones that decide what the price is that they list it for.

Joey: Exactly.

Josh: But it's a collection or a collaboration of what a buyer and a seller are willing to do in a deal that actually establishes the market, and that's where the market is. So there's no fault in testing the market. There's risk involved in over-pricing 'cause you could sit on the market for a longer period of time. And the attractiveness of a brand new listing starts to diminish quickly if it sits on the market for too long. So it has an impact on value. So sellers, when they come on the market, it's wise to probably try to nail the value as soon as you can. 'Cause if any... In the worst-case scenario might get competing offers selling it for a higher price anyway. Whereas if you over-price and you miss that window of being the new listing and now you're... The value of that home might begin to diminish in the eyes of a buyer, you could potentially sell for less than what it's worth or what you could have gotten if you would have priced it right out the gate. And so it's always a... Listing properties is challenging. Sellers have a... They're challenged in that. And agents are too.

Joey: It's funny the psychology of days on market. I have... 'Cause I practiced real estate at one point. And when people would say like, "Yeah, I like that house and everything. But look at the days on market. We're gonna... " It's like... Then they watched an episode of Pawn Stars and they're just like, "So hey, let's offer them 50 cents on the dollar." I'm like, "What? What?" So it's a huge psychological factor where there must be something wrong that we're missing. Why has it been in the market so long? It's like maybe it's waiting for you.

Josh: Yeah, you're right. It's interesting you say that because I think that over the years I've noticed that there's a... The days on... Well, price reductions, for example. I've had sellers over the years ask, "Well, the price reduction, is that gonna make us look desperate?" And I'm like, "No, it actually makes you look motivated." So buyers interpret price reductions as motivation. But they interpret days on the market as something's wrong with the property. And so that's been our experience of what we've observed over the years of talking with buyers and sellers. And so that's a pretty big aha, I think. So don't allow days on market to accumulate too much. And the exception of that, of course, would be is if you have an extremely unique property or you're in a very unique price point. Well, then it could take days on market to find that person. So I'm not saying it works for everybody. But for the lion's share of the inventory that gets moved through the market, it should be happening in a reasonable amount of time. And if you're sitting too long, there's probably something wrong.

Joey: And then there's two points in my mind that come out of that. Number one, the importance of a good market... I was gonna say like market analysis. Market analysis. Market overview.

Josh: Yeah, yeah.

Joey: Saying, "This is what we're seeing your home is worth." And it's not an art form. It's actually a science. It's just not everybody practices that science fully. It's like a math problem that's got about 30 variables, but most people are like, "Can we just stop at six variables?" Well, then you might sit on the market or you might have like, "Wow, that sold so fast." You were a little under market. So it's important. Market analysis of a home is super important.

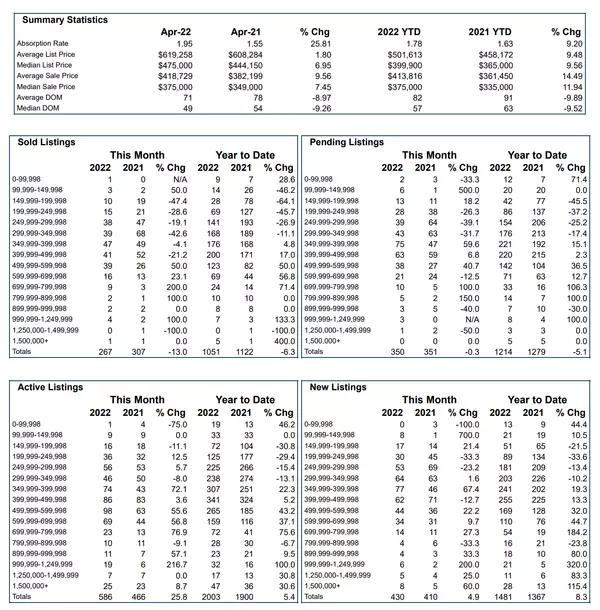

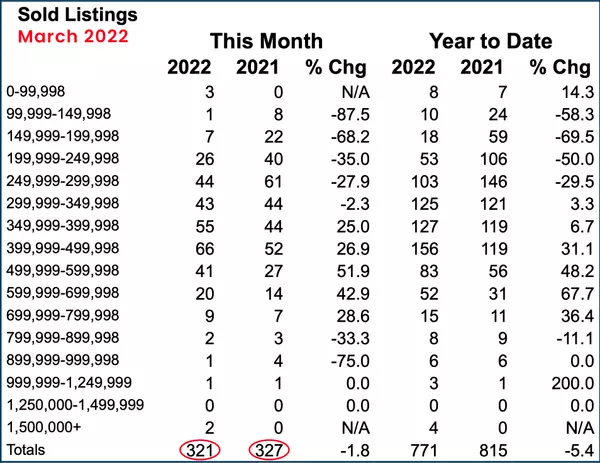

Josh: It is. So what we kinda do in that regard is we'll look at the market from a national perspective first. So we'll look at the overall availability of financing. Lenders kinda refer to it as availability of credit. And then we look at the overall interest rates. Because those two things have an impact on what's happening in your county. And so then in the county, you look at what's overall happening in each price range in terms of supply relative to demand. And then we go one layer deeper, which is to look at what's selling in a particular subdivision or homes that are similar to the one that you're comparing to. And it's that holistic approach that really gives you a really good perspective on what the market's doing. And so like for example, right now, between $500,000 and $600,000, the inventory in the last 60 days has jumped dramatically. I mean, it's up almost 65%.

Joey: Oh wow.

Josh: So yeah, a year ago we had 50-60 homes for sale in that price point by the end of March the last year. And this year, at the end of March, we had like 115.

Joey: Oh wow. The buyers have options.

Josh: Yes. And it's because of those interest rates. So when those interest rates went up, it had an impact on purchasing power by up to, at this point, about 20-25%. So, buyers that were qualified six months ago at two and three-quarter percent, they're qualified at 25% less today. And so that's starting to show up in our inventories.

Joey: That's a huge number.

Josh: It is. It is. I mean, we're still in a seller's market. Our inventories are so tight, that it's not having an impact on value at this point. But because the inventory is growing, days on market could get extended. We could expect to see... If it continues to happen like this, we could expect those prices to definitely plateau. I mean, that first shot across the bow of the Fed raising the interest rate a quarter percent and the corresponding effect of the tapering, reducing the amount of mortgages that they're purchasing now, it's starting to show up in the mortgage market. And I told our agents the other day, I said, "Make sure that our buyer clients in the market understand that what's happening with the interest rates was on purpose."

Josh: The Federal Reserve is actually making an attempt to prevent the housing market from appreciating at the speed that your milk and your eggs and everything else is going up. And they're doing everything they can to target that so they can prevent homes from getting out of reach and having it not be affordable for anybody. Do you know what I mean?

Joey: Yeah.

Josh: There's absolutely the impact of inflation. So if I were a buyer in the market right now, I'd just be grateful the rates are higher because it's that targeting that they're doing right now that's preventing those home prices from going up higher.

Joey: It's about a year ago, I was listening to... I wish I could remember the gentleman's name. I know you'd know who he is. It's like Ali Abdelaziz or something like that. He's a famous guy. Bear Stearns brought him in. And he gave an hour of talk, and he talked about some of the driving factors in the real estate market. And he talked about how after 2007, 2008, because of what happened, there was... Almost all new construction slowed down to almost zero.

Josh: Oh yeah.

Joey: And so there was this glut of people that were coming up, that were gonna be home buyers, but there was no replacement of inventory, and it was gonna hit... It was already starting to hit, but he said it was really... He laid out several factors on why, 'cause we're like, "Why is the housing market going crazy?" We're not seeing those loans where you just pull out the equity, buy the second, pull out the equity, buy the third. Something is driving it, and it was that there were a lot of people that are... Were living at home in their early, early 20s, and they're ready to buy, and there's nothing there. There's no inventory. It hit at the same time as a global pandemic... There's just a lot of factors. Like the pandemic hit it...

Josh: Yeah, and you're touching on like the family formation, even though they may not be forming a family, it's like you're getting out of the basement. And you're having more people wanting to participate in the housing market in one form or another. Because you've got one or two options when you move on when you move out of mom and dad's house. You're gonna go rent and rent with friends or rent by yourself, or you're gonna go buy a house and maybe rent a room to a friend or something. But you're gonna do one or the other. So right now we're over five million housing units short in the country just to meet the existing demand. And right now the population in the country is still growing. So either way, there's gonna be an impact. So right now, with interest rates going up, if our sales volumes drop, which I would say that's probably the safest estimate to say that sales volumes as interest rates continue to go up, if they do, which I think all the experts are saying they will, it's gonna have a corresponding effect on demand. And those buyers who don't buy that home, where are they gonna go?

Joey: They're gonna rent.

Josh: They're gonna rent. And what it's gonna happen to the rents?

Joey: They're gonna go up. They already have.

Josh: Because the demand is going to go up.

Joey: That's right.

JB: And so as the rents go up, now the cost of homeownership or the value proposition of homeownership becomes more attractive because it's like, "Hey, I'm paying $2,500 a month for rent on this place," or "I could buy a home very similar at $2,300 a month." So why don't do that? You know what I mean?Joey: Yeah, absolutely.

Josh: When I hear all these things about this massive crash, and I'm not here to have a crystal ball, maybe there's some crazy thing that I don't see, but I don't see a headwind that puts us in a housing crash. And the reason why? 'Cause people need a place to live. Reason why? We have five million housing units short. Reason why? Family formation, people moving out of their parents' houses, people wanting to buy rentals, immigration. All of that stuff that's happening is having an additional demand on the existing housing supply.

Joey: Especially with like we talked about in California has... It lost people. We lost, for the first time, a Congressional seat, but Redding is the exception inside that rule where it's like, "No, people are leaving Los Angeles."

Josh: Correct.

Joey: They're leaving...

Josh: Big cities.

Joey: Big San Jose, but not everybody is leaving the state. A lot of them are coming into this area, and we have... It's very hard to replace inventory in the Redding area. Very, very hard.

Josh: Well, and I read an article that wasn't too long ago, I think it was a Hoover Institute if that's the one that's out of Stanford. So don't quote me on that, but I think that's where I read it at. But the number one reason for moving out of the state, and some of these people will probably think it's politics, but what it was on that report was affordability.

Joey: I was gonna say taxes or housing or something. The fact that you make $150,000 a year in San Jose and you're sharing an apartment with three other people.

Josh: That's right. That's right.

Joey: You can't buy... And that's like, "Wait, that's a good pay for an engineer in mid-20s," and so if you have a teleworking and stuff like that...

Josh: Well, and that ties back to my point of earlier with the sales team we talked about a few days ago where I said just, it's a great thing that the Federal Reserve is raising rates. They've gotta do everything they can to essentially try to prevent the housing market from inflating with this inflation we're experiencing right now. They've got to. Because you can't have housing, the value of homes goes up and then drop right away. That's a negative impact on a lot of families, right?

Joey: Yeah.

Josh: So when you're going through this major issue where you have a supply chain disruption, you have probably labor participation, access to the supply chain lines, all these things that are going on that you've gotta be careful with that are causing a lot of the inflation we have right now, you don't want that to transfer into the housing market at this point, because it's probably short-lived. 18 months from now, I would imagine supply chains are probably gonna be, I'm not saying the 100% back to what they were, but they're gonna be much better than they are today. You know what I mean? So if prices start dropping everywhere else, but now your poor house was overvalued and now it's dropped a lot, that wouldn't be good either. I think the Feds are doing a good job. I'd like to see how that impacts the market going forward, 'cause all the experts are saying the rates are gonna blow up a little bit more.

Joey: Yeah, I was thinking about of all the headwinds and tailwinds because you just... You named a lot of tailwinds. All the headwinds and tailwinds in Redding, the interest rate seems like the only real headwind, 'cause our housing inventory is still tiny.

Josh: It's still tiny.

Joey: Like how far are we off?

Josh: Well, right now we're at about 1.8 months supply of housing. It's called our absorption rate.

Joey: That's it?

Josh: Yes, and so for our listeners, what that means is that if you didn't... If no other homes came up for sale, it would take 1.8 months to sell off 100% of the existing housing inventory. Now, by definition, that is a seller's market. So anything up to three months as a seller's market. Four to five months is kind of a neutral market, and then six months and beyond is what's considered a buyer's market. And again, we're at 1.8 months supply. And not every price point's the same. That's the overall number. If you get into that price point at $500,000 to $600,000 and $600,000 to $700,000, and all those things as the price gets up in those higher ranges, that absorption rates growing. It's higher. It's a higher number than 1.8. And in some cases, it's considered to be a buyer's market. The upper-end market tends to be more of a buyer's market. Why? 'Cause the demand is lower than the supply.

Joey: Yeah. And also they're not as influenced by interest rates that you're gonna allow your cash buyers or people that are putting such large amounts down that the interest rate doesn't affect their purchasing power, like it does when you're in...

Josh: It doesn't usually affect the home they're going to buy.

Joey: Yeah, yeah.

Josh: Whether they wanna buy or not, it might. But what they buy not as much.

Joey: So housing inventory is still very low, interest rates have gone up, we've got inflation. So inflation, the interest rate is an attempt to control inflation in the housing, so the Feds doing this it just sounds so counter-intuitive from hearing a real estate broker say like higher interest rates are a good thing.

Josh: Well, if you're not thinking only about yourself. If you're looking at the next generation, you're looking at the folks, you know... I've changed now when I was like 25, 30 years old. I'm like. No, I want the rates at zero, right? Because you're trying to do everything you can to leverage and all those things, but I think as you get older, you begin to realize, you know what? There's a whole lot of other people that are impacted by all the things that happen. So I want my kids to own homes. I don't want to them to get priced on the market. I don't wanna see them have to leave the Redding area because they can't afford to live here. That's what's happened to folks in the Bay area. Let's say you grew up in Sunnyvale, California. And like a year...

Joey: You saw some change.

Josh: You saw some change.

Joey: In your life.

Josh: And a lot of your kids might have graduated from college in the Midwest somewhere, they came back to their town in Sunnyvale, and all of a sudden they can't even afford a home anymore. And so now they're saying, "Sorry, mom and dad, but I'm leaving the state." And you don't wanna put your kids in a situation where they can't afford to live where they've grown up, if that's what they wanna do. So for those reasons, I'd like to see housing... That's a selfish reason but that's what I wanna see. But I think when you look at the housing overall right now, I think you could argue that right now prices are probably still fairly priced for what you're getting... Think about the work and the effort that goes into getting to acquiring a home and building a home and all those things, I don't think we're way out of whack on value right now.

Joey: Well, it's funny 'cause the number, it's... The other day, I was listening to a couple of guys talk and they were... 'Cause it's tax time, right?

Josh: Yeah.

Joey: So people are like, "Oh, my accountant told me I need to buy... " And it was two guys talking and one of them went and bought $103,000 truck. And the other said, "I raise. I bought $119,000 truck."

Josh: Trucks for that price?

Joey: One was a... The 103,000 was a brand new GMC Denali full one tonne, cup holders.

Josh: You spend 120 grand on a vehicle like that, it better do my taxes.

Joey: That was the motivation. And they had cup holders and everything. They're really, really stacked... Windows rolled down. It was really nice. But no, but they're saying that I'm just like, "Wow, if you're willing to pay 100-plus thousand dollars for a truck, not an 18-wheeler, but just the truck that's gonna be hard to park when you go to Costco, like suddenly a house for 380,000, that's three of those trucks."

Josh: No, well, there you go, you're talking about inflation in a major way. And the dirty little secret that probably people wouldn't believe when I say this, but the federal government wants inflation, the Federal Reserve wants inflation. If you were to go right now online and look at the Federal Reserve, they will tell you in black and white, in writing, that their target inflation number is I think 2% or 2.5%, that's their target. That means that if it was at zero, they would want more inflation. And so it's just a variable that they're working with all the time, and clearly we've out shot it now for the reasons we talked about earlier in the podcast, but inflation right now, it's here to stay. And honestly, they want it.

Joey: I was just picturing Charlie Sheen as the chairman of the Feds going, "Winning!"

Josh: Well, they're winning right now. And it's scary for a lot of people, especially for those who are watching this or listening to it and they're on a fixed income. When you're seeing all of these things around you, that your services and your different supplies and your food and all the things that you need just to sustain, and your energy costs, and they're all going up, and you're on a fixed income. Those are the people I feel the most sorry for. If you're participating right now in the labor market, it's not affecting you quite as much because your wages potentially are going up, and they certainly could over time because you're participating in a labor market. Where people are on fixed incomes, that's the sad part of this story right now, and that's a big reason why we need to get that inflation cooled down a little bit. Interest rates are gonna be an attempt to that.

Josh: Federal Reserve's coming out again and said that they're very aggressively gonna raise it again. We have to wait 'til they do it, but that's what they're saying they're going to do. And all of us in every asset class is gonna be impacted by interest rates. And Warren Buffet I think says it best, that interest rates serve as gravity to value. And so when he gives the illustration, when he says, is that as the interest rate goes up, the gravity on value gets stronger and it pulls value down. Does that make sense?

Joey: Yes.

Josh: Alright, so when interest rates are extremely low, the gravity is low, and therefore everything inflates in values. That's why the stock market's been on fire for so long, that's why the housing market's been on fire for so long. It's because the rates were effectively at zero. But now that the rates are starting to move up, it serves as gravity, and it slows down that appreciation piece. And in some cases, it even pulls it down if it gets really high. So the Fed knows this, they know the power they have in their hands and they're gonna be... They're gonna be working towards it.

Joey: So what do you foresee over the... I mean we are in the, this is the time of year that listings come to market, spring. This is when people from Sunnyvale, Los Angeles, Fresno, and Bakersfield come up and check out the area. What do you see over the market for... Obviously, look deep into your crystal ball, Josh. What do you see for the next 90 to 120 days?

Josh: This market's gonna feel hot and strong and powerful, I think, until either the Federal Reserve raises interest rates significantly or we...

Joey: Again?

Josh: Again. Or we get to the end of summer. I think one of those two things, because we're in that cycle side right now, where we have our normal higher demand, where we have more people moving in from out of the area at this time of year. And we really see that strong market every year, all the way through summer, and I don't see this year being any different. The appreciation piece will be a challenge because as interest rates go up, it's gonna have an impact, like I said, like gravity, it's kind of an impact on appreciation in the market. So I'm not saying prices are gonna be anything close to what they were last year in terms of how fast they appreciate, but I think that we could expect to see some decent demand. And then I think by end of summer, the real question will be what will have that impact been on interest rates in the market.

Josh: So the long-term story I think is still strong, because people still need a place to live. We're not over-supplied like we were in 2005 and six when it comes to homes available for purchase, we're under-supplied as a nation. So I think there's better days ahead for the real estate market itself, but we're gonna have a short-term reconciliation and we gotta get through that piece.

Joey: That's what I was wondering if you saw anything in the market that you said the properties, the pricing is... You're very attuned to the market. I look at a couple of listings and go, that seems a bit, like I'm happy for you... Like my neighbors have a house listed, and I'm like, "Man, I hope you get every penny." But I feel like you... This is Fonzie jumping the shark. Like, no.

Josh: Well, and what you have to do is you have to have a short memory, I think, when it comes to value on homes. If I was to take my experience from 20 years ago selling real estate and took that experience in today in terms of value, I'd be underpricing everything, right? Yeah, so what you have to do is get back to what I talked about earlier on the podcast, which is looking at the national statistics, look at the county statistics, and then zoom into that neighborhood and look at what's going on around your neighborhood right now, that's where you're gonna arrive at the most accurate evaluations. Don't be thinking about five years ago, don't be thinking about 10 years ago, because buyers can't buy from five years ago or 10 years ago, they're dealing with what the market is today, so.

Joey: Well, Josh, thank you for your time. I hope people got value out of this, and it's still a seller's market, and if you need a real estate broker.

Josh: I'm here to help.

Joey: Awesome, thank you, sir.

Josh: Yeah, thanks a lot.

Recent Posts