Josh Barker Real Estate Podcast Episode #4

🏠💰Home Value Tool➔

Frequently Asked Questions

What are interest rates for homes right now?

Mortgage interest rates have been going up over the past several months. For example, December 2021 average 3% for a 30 year fixed mortgage and increased to an average of 4.25% by February 2022. A one percent increase in the mortgage interest over 30 years decreases a borrower's purchasing power by an average of 10%.

What causes interest rates to rise?

Mortgage interest rates are impacted by multiple factors. Two of the most common are the demand for purchasing mortgage backed securities and the interest rate set by the Federal Reserve.

What happens to house prices when inflation rises?

Inflation "The increased cost of goods or services" is largely created as a result of demand overwhelming the existing supply of goods or services. Raising interest rates is a measure taken by the federal reserve in an effort to reduce demand.

Is right now a good time to sell your home?

When selling your home, timing can have an impact on the price your home is sold for and how long it may take. Ideally, the best time to sell your home is when demand is high and you have a plan for what to do with the proceeds from the sale.

Transcription*

The transcription is auto-generated by a program and may not be accurate to the conversation. In order to ensure you get all the information from the video properly, you must watch the video.

Joey: It's February of 2022.

Josh: Yes, it is.

Joey: And like some big stuff is going on. We were looking at interest rates right before we started recording.

Josh: Yep.

Joey: And they jumped a little bit.

Josh: They did. Yep.

Joey: I mean, quite a bit.

Josh: Yeah, we were kinda waiting for that one, right?

Joey: I don't think we expected it to be quite that much though.

Josh: Well then... Yeah, I wouldn't say that fast, but the federal reserve last year, they already said that they were going to be tapering. Reducing the amount of mortgage-backed securities that they were purchasing. And knowing that they've announced they're gonna be raising interest rates this year. So, I think everybody kind of anticipated that the long-term interest rates for mortgages were just gonna go up, but last 90 days, it's jumped a lot. We had a client we talked to then early December, locked in around 2.8% on a mortgage, and now today, just before this podcast, I just checked, and it was like 4.5% for a 30-year mortgage.

Joey: And that isn't even the feds increasing the rate yet, that's simply them slowing down buying the mortgage back

Josh: Securities.

Joey: Securities.

Josh: That's right.

Joey: So we haven't got to the...

Josh: We haven't even got to the interest rate portion yet.

Joey: Yeah.

Josh: Yeah, the interest rate portion has a lot more to do with inflation because we just have the numbers that came out a few weeks ago. What was it? Was it 7.5% inflation I think is what the federal reserve announced, as what the inflation numbers were? Kinda sent the stock market in a little bit of a tizzy for a few days there.

Joey: Yeah, so... And I understand the interest rates is... The idea of increasing interest rates is to try to slow down inflation.

Josh: Yeah.

Joey: Right? And I don't know, that's a whole... Economics is one of those sciences that's like... It's just incredibly subjective.

Josh: It is.

Joey: It's not like chemistry where you're like, no, that's... "Water is H20".

Josh: Yeah.

Joey: Economics, they will argue all day...

Josh: Yep.

Joey: What does what to what?

Josh: Yep.

Joey: So the bottom line is that's a major headwind. Sticking with the vocabulary that we've used so far.

Josh: Sure.

Joey: That interest rates going up slows the market down.

Josh: Oh yeah, they'll... Definitely. I mean, that part of that spy design right? So you've got two different things working. I mean, this podcast is more around real estate, but in reality, the federal reserve isn't just looking at real estate, it's looking at the entire economy and saying, "Okay. Well, the numbers are pretty bad". The inflationary rate is right now at 7.5%, so they have a choice to make, right? So you've got demand that's exceeding supply and supply... The big reason why supply isn't where it needs to be is that you have the supply chain disruptions, which we're pretty explainable with COVID the way it was. But also because they can't catch up. Then the debt man right now is over-running supply, you're seeing inflationary prices across the board. Fed has to make a decision, it's like, "Well, do we raise rates and reduce demand, which could put us in recession, right? Or do we let this economy continue to burn pretty hot?" And I mean if... I'm not a betting man, but if I had to bet, I would bet they're gonna let this economy continue to burn pretty hot. I think they... They'll either raise rates a little bit, I'm sure. But I think ideally, if they had the choice between some inflation in the market, that's higher than historic norms or a recession, 'cause that's kind of the two choices you have as the Fed. I think they're gonna let it burn a little bit. I think they are gonna let it run hot.

Joey: So with inflation going up and interest rates... Interest rates, obviously, they are gonna go up again.

Josh: Yeah.

Joey: Because they have to. They have to... They said they're gonna raise the rate.

Josh: Yeah.

Joey: What does that have to do with the Redding real estate market? What effect is that gonna have? Like sellers and...

Josh: Sure. Well, for our listeners on this, I think the one thing to realize is that for every 1% that the mortgage interest rate increases, it has an impact on purchasing power by up to 10%. And so there's some real impact around buyers' ability to purchase the same homes as rates go up. So let's say you're qualified for a home in a particular neighborhood right now, and let's say that the average neighborhood price is 350, right? Well, if the rate goes up 1%, well, you may not be able to buy in that neighborhood anymore. You might be looking to buy in a neighborhood that's around 275 or 300 or something. So that's the actual real cost of interest rates going up for people, because most people buy homes based on what they can afford for a monthly payment. And so as rates go up, the loan amount they qualify for goes down, and it has an impact on the type of home that they get to purchase. And that's... If you're trying to bring this into a practical conversation or in real estate, that's where the impact is. Because people typically, they have an amount that they have budgeted for the mortgage payment, and that amount is not gonna change based on rates. What's gonna change is what they can buy without a payment. You know what I'm saying?

Joey: Completely, I'm immediately thinking that's gonna affect the lower end of the market way more than the mid to higher end of the market.

Josh: Probably. Probably, because people on the lower end tend to be more at their max monthly payment when they go to purchase that first home. They figure out what the lender says, "Yep, you're qualified up to X", and they're gonna probably push it as close to that as they can because they want the very best home they can get in that price point. Whereas if you get into the upper end, it's more of a discretionary decision as to what size of home you want, what's the payment gonna be, because you're not usually running up against your max payment in the upper end, you usually have more reserves than that. So... Yeah, I agree with you. I think that it's gonna... It's gonna play out more on the up... On the lower end, it's gonna have a much more meaningful impact.

Joey: Now that's obviously a big headwind, but we've got some big tailwind still going in Redding...

Josh: We do.

Joey: For example, how many permits were pulled we were talking about...

Josh: Oh man.

Joey: In the last 12 months...

Josh: Yes. Yeah.

Joey: In the city of Redding...

Josh: Yep.

Joey: It's a tiny number.

Josh: It is. So there was a report that just came out recently, so in the city of Redding, there's roughly 2500 paper lots approved in the City of Redding. Those are lots that are ready to be developed, right? And last year we had roughly 200 permits pulled to build a new home in the City of Redding.

Joey: Less than 10% of them.

Josh: Yes.

Joey: Way less.

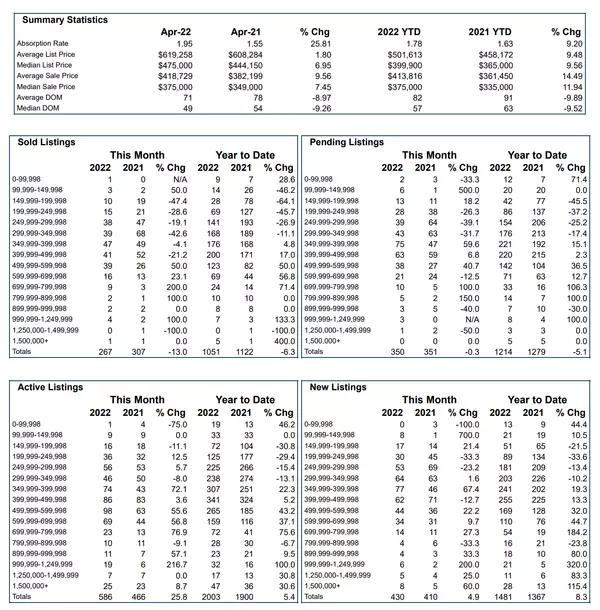

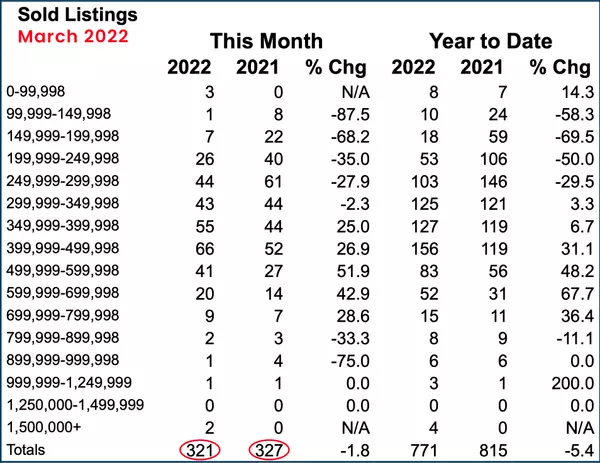

Josh: Oh man. And so you have this really low amount of new inventory coming to the market in the City of Redding. If you look at the actual home inventory right now for single-family residential homes right now, 300 and roughly 80 properties that are actually for sale right now in the entire Shasta County multiple listing service. And we have over...

Joey: That's pretty low.

Josh: Oh, it's super low. And we have over 200 selling each month, right? So probably this month, we don't have the numbers for February, 'cause we're in the middle of it, but let's say it's 260 or so homes, that are gonna be sold this month, that means that it is just over a one month supply of homes. And for our listeners, what that means is like if no other homes came up for sale, we only have 1.2 weeks or 1.1 weeks of inventory before there is no homes for sale. That's how tight it is. And so it's definitely still a seller's market. And now you have inflation, you have a really low supply of homes available for sale now. And you have even fewer homes coming as new inventory coming to the market. Everything's pointing on that tailwind. Everything's pointing towards appreciation still this year. And we'll probably see a lot of it in that first six months of the year.

Joey: I was gonna say those numbers that we talked about, the tailwinds, to me, seem like they would far exceed the headwinds. The headwinds are probably gonna affect other markets, big time, especially the larger cities in California. I think it might even drive more of this real speculation here. But it depends on how many people are moving here versus how many people living here are buying homes.

Josh: Yep, yep. So some of our demand is coming off the... Is backing off a little bit. So when you run our sales reports right now, you can see that our demand has started to slow down a little bit over the last six months. It's just been slowly coming back to a...

Joey: Well, they're still white-hot. I mean, it was so crazy last summer.

Josh: It was. And a lot of that was because with the pandemic, you had a lot of people that had the opportunity to work from home or decided to buy a second home and had some other options available to them. So they could move into where they wanted to. And Redding was a great place to go. And especially if you were in Sacramento or the city of San Francisco or Southern California, whatever, Redding kinda tends to be a good place to go. So we had some additional buyer demand. And a lot of those types of transactions have slowed way down now. And so now we're starting to see our actual monthly sales volumes drop compared to last year. And it's been like that for several months now, where it's been like that. But the inventory is still just so low that homes are still selling quickly. Buyer demand is still pretty strong relative to the supply. And that's why I still think if I was betting on anything, I'd say that I think the tailwinds of the market right now are gonna push and overcome the headwinds. And we'll see appreciation again this year.

Joey: Plus we're gonna see... Right now, if you are thinking about selling, some of the things that are poised for this year are a couple of more interest rate hikes. And so you can get ahead of those, sticking with us, get ahead of those headwinds.

Josh: Yeah.

Joey: It's like where there's a sailor. Just go, "No, you're not using this right." Bad analogies. But inventory is so low right now. And the interest... I just wonder how quickly those interest rates impact purchases. You were looking at that number this morning. So there's a bunch of people that were shopping, did they lock in their rate? Hopefully...

Josh: Well, I was gonna say, it can hit you immediately. So if you're one of those buyers that was right on the edge of qualifying for that loan amount, okay, based on what your monthly payment you could afford was. And you're right on that border. And now the rates go up, let's say a quarter point last night. And you didn't lock your loan, you might be in a situation where you can't buy that home today.

Joey: Oh, wow.

Josh: One of the things that we're doing right now is that as we're working with buyers, we're educating them on the fact that the feds are gonna likely raise rates again in March. And we're anticipating that there'll be a higher rate environment than what it is today. So be in really close contact with your lender. Be ready to lock that loan as soon as you and your lender agree that it's the right time to do it. And don't put yourself in a situation where you are qualified today and now you're not qualified tomorrow. And these are conversations that a lot of buyers should be having with their agents. They should be having them with their lenders. And when we know, everybody's telling us rates are moving up. And so if you're the guy that doesn't lock, or you're the girl that doesn't lock right now, that's a pretty big risk to take. So I'd be looking at it.

Joey: And as far as sellers go, if you wanted to sell it, there's nothing really you can do about it other than... This is a good time to enter the market. Because the inventory is still low. And the feds haven't increased the interest rate yet. So, okay, it's not as the interest rate isn't as good today as it was yesterday. But it could be a lot better than it is tomorrow. So it's kind of like... The idea is... I don't know what kind of seller would be like, "You know what? I'm just gonna sit this one out and wait it out." It's like, "I don't think that's how this is gonna work."

Josh: Well, it's tough. Right now, if you're a homeowner and you're thinking about when's the right time to sell, well, probably the best time to sell is before the buyer demand starts to decrease faster than the supply is coming up.

Joey: Yeah.

Josh: It's hard to time it.

Joey: Catch the tailwind.

Josh: Yeah, exactly. Be on the tailwind side of it, so that you have competing offers or have some better options in terms of who you sell your home to for down payments and quality of the loan and all that stuff. But what I would think is, is that what most of the experts are saying right now is they're projecting anywhere around five and a half or so appreciation nationally this year.

Joey: And that's nationally.

Josh: That's nationally. Yeah, so different markets are gonna perform differently. That's just the national average. So let's say the Redding average is between 5% and 8% between now and summer. Because that's typically when we do appreciate here. We appreciate coming out of February, March is when we start to appreciate it. And we start to plateau out somewhere around mid-summer in terms of appreciation for that cycle, kind of flattens out for a few months. And then it might get back a few points before the end of the year. And then it starts the cycle over again. That's just kind of the way our market's always been.

Joey: Well, the weather... I mean, the weather right now, anybody that's gonna visit Redding right now and think like, "Oh my goodness, this is... " Before like, "Hey, come back in August."

Josh: Yep. Oh yeah.

Joey: "It's gonna be a little bit warmer. The grass isn't gonna be quite as green."

Josh: I think it's a real good idea. I see people that move up to Idaho, they go up to Montana or whatever. And I've seen a few folks that have come back from that too. 'Cause after you do a winter there or two, you realize, well, the things you don't have to deal with living in California at least in the valley anyway, of California, that it's pretty convenient. When you have to factor in for shoveling out your driveway and the sidewalk to get to your front door as a part of your normal day, and you're not used to it, 'cause you're from California, you sometimes decide that's not the best thing for you.

Joey: Well, we had a couple of friends that left in the last year. And they went east. And we were talking to 'em. And they were both in different locations like it's just these snowstorms keep hitting.

Josh: Oh yeah.

Joey: Yeah, it's not...

Josh: Every place has its thing.

Joey: Something.

Josh: For us, we have hot summers, man.

Joey: Yeah.

Josh: I'd rather be in Montana in the summer. Now, that's for sure. But in the winter, I like California. I'll take it any day of the week.

Joey: So thinking about the market, thinking about these headwinds, are there any other headwinds coming down the pipe besides interest rates going up and them trying to control inflation?

Josh: Well, it's interesting. Because when I think about that, I go, "Well... " I'm always thinking about the demand and the supply piece. Because it always tends to be where the story is gonna go, right. And right now, there's a lot of contributing factors to why our supply is low. Part of it is the supply chain disruption. So we can't re-supply the market with new homes. But another part that we haven't talked about in this podcast recently, anyway, is that. You have these large hedge funds that have been buying up homes nationally, and that has really had an impact on the overall inventory. We had Zillow, they bought, what, 500,000 homes or something like that. It was an insane number.

Joey: I'm sure Hathaway is big into it.

Josh: They were buying... There were so many companies that were participating and buying them and some of them are buying them through that iBuyer program, and they had their intention of flipping 'em, for higher prices. But we had some of them like... I don't want to mention any names, but there's some hedge funds out there, that are actually buying these and actually holding them as rentals. And so they're removing these properties from the housing supply for buyers to choose from, and I think now it's beginning to show up in our numbers nationally, I think this is a big contributing factor to where the inventory has been eaten up so badly. You already had a pandemic, you already had a supply chain disruption, now add to that hedge funds buying up the existing inventory and that really starts to explain where this problem is.

Josh: If those companies at some point decide 'cause they're holding them now, if those companies at some point decide that the best investment is to liquidate them, that could quickly re-supply the market and have an impact on value. And it wouldn't necessarily be because they voluntarily did it, it could be because the Federal government goes in and says, Okay, well, we're gonna carve out a new tax implication for companies that do this particular activity, and that itself could have a change on who wants to hold inventory like that. So there's gonna be some interesting things we're all gonna learn about what happened in the last couple of years with inventory over the next year or two, I think there'll be some lessons that'll be learned from it, then there might be some policy that comes out of it too.

Joey: I was just thinking, I know the formula for why a company would come in and buy a thousand homes. The thoughts would be, okay, well, because they think the market's gonna appreciate at such a rate that and they have a physical asset versus stocks or something like that. And then, okay, what... And like you said, there's oh... Especially there's tax implications, maybe they do it because they're like, no, we're gonna actually have rentals, this is gonna be... It's not just the appreciation, but also like the equivalent of dividends. We're gonna collect rent. So I'm thinking, well, what is the motivation then for them to start letting go of this inventory other than the government coming in and changing tax...

Josh: Well, you'd have a couple of things. You've got... If you feel like you're at the end of an appreciation cycle and now it's time to take the profits from that investment, that might be a reason to start liquidating some of those. If you wanted to diversify that portfolio beyond what it is now, then maybe you would liquidate a percentage of those and reallocate that investment somewhere else. So there's a lot of different reasons why they could do it, I just... What it concerns me is that at any time one particular entity has a whole lot of inventory at their discretion to dump to the market, that's something that everybody should be paying attention to.

Joey: Do you have any numbers? Do those entities exist, so to speak, in Redding, are they... Is there... Do we have any numbers that show that kind of stuff? Is this an LA thing...

Josh: I would say other places in California. Yeah, so for our listeners that are in Redding going, how much of that's done here? No, nothing and nothing in comparison to the areas that I'm thinking about, but it does have an indirect impact on us, and that's because it actually, those investors that may have otherwise been buying in those areas because now they have appreciated, they might be looking at areas like Redding, so now you have people that might be looking at other places to invest because those other places that they were investing in aren't as profitable as they used to be. So it does move investment activity to different areas when you have participation from large companies that come in. So for example, if a hedge fund came into Sacramento and bought everything. Well, then if you wanted to buy something you wouldn't buy in Sacramento. You'd probably be on the outskirts of Sacramento. You know what I mean? And then if that supply then was resupplied back to Sacramento, well, then everybody starts coming back. So it's just... You just see a large manipulation in home inventory being impacted by these hedge fund companies that are coming in. It's concerning for me, for sure, but who am I? But I look at it and I go, whew, that's something that we all have to watch going forward, 'cause it could happen here. So what's happening somewhere else could certainly come to Redding.

Joey: What I was thinking about when you were talking, I was thinking about the two movies, one Margin Call, and The Big Short, both movies, I think one was a play and the other was a book based on mortgage-backed securities and how they just over-extended themselves. Now, we've talked about that before on the show. Just talked about the factors that are driving now are not really the same factors at all. There's a couple of things are going on, but back then you had people that were non-owner occupied, it took up a huge percentage versus now. And so these were people that were super extended with mortgage on top of mortgage on top of mortgage. I don't even hear anything like that, and in the past, you've said the numbers look like maybe 10% investors, which is actually a small number.

Josh: Very small number.

Joey: So, I'm just... I guess, my mind is like is something... Should we be concerned at all?

Josh: I don't think so. I don't think we need to be concerned about those hedge fund examples here. I think it plays into the bigger national narrative that we have low housing inventory across the entire country, and it wasn't helpful that hedge funds went in and started buying up these properties too, 'cause that just ate away at that inventory as well. Nationally, right now, we don't have enough homes and what I mean is that there's more people who would like to own a home or be able to live in a home than we have available. We don't have tons of new construction sitting up and down the state of California right now and certainly not in Redding, California, where there are all these new homes sitting there with nobody to buy them. That's not the case.

Joey: No, at all.

Josh: Every contractor I'm talking to you right now, they're a little nervous about the economy right now, and they're a little nervous about inflation, they're a little bit nervous about buyer demand, but everything's telling them that they're gonna be okay because the buyers right now are just lining up saying, we want another house, we need another house, and they're trying to get these builders to build. And so if you're a builder right now, you've got all the signals telling you currently, it's okay, go build some more houses, there's plenty of buyer demand. But a lot of them are also being thoughtful of the fact, "Hey, we've got some inflationary pressures and depending on how aggressive the Fed does get with interest rates, that could slow this whole thing down", but like I said at the beginning of our podcast today, anyway, I'm not a betting man, but if I had to bet, and if the Feds left with two choices of deal with some inflation that exceeds the norms, or put the country into a recession, I have a feeling they're gonna let this inflationary period continue to run. It may not be running at 7 1/2%, when they raise the rates a few times, maybe it levels off at 5%, or 6%, but I think they might rather have that for a little while, than have the recession that would be required to bring that demand back down.

Joey: 'Cause... I don't know if you know the answer to this, but I think they say a healthy inflation runs like 2 1/2%, or something like that?

Josh: Yeah, but I mean, that's still pretty... I mean, yes, that's correct.

Joey: Isn't what they say?

Josh: Yep, that's my understanding of it too.

Joey: And then, would do you think housing appreciation should track that, and maybe even be exceeded by it a little bit?

Josh: It's the best way to be. Oh, it's usually... I mean, if you can have housing around 2%-3%, which never lasts for very long, but if you could average that, it'd be wonderful because in theory, it's tracking with inflation for wages, and things like that, and you don't wanna be volatile in the housing market because this is homeowners, they need to have the flexibility. You start manipulating the housing market, and people stop buying. [chuckle] And if they stop buying, well, then you don't have that investment infrastructure that the country really gets to enjoy, because so many of our citizens in our country own homes. Well, that's a built-in security for the country, really. And so you don't wanna see that get disrupted like that, because then you could see neighborhoods, and cities literally just get changed overnight, based on policy, so... But I think that if we look at what inflation is now, the good news is that the supply chains at some point... Let's say in the next 24 months supply chain start to catch up. If we're running at 5%, or 6% inflation after the Fed makes a few moves on the interest rate, and we're still running kinda hot on inflation, but then all of a sudden the supply chain starts catching up, well, now all of the products that are available are meeting the demand, and we'll start to see inflation start to cool off. I think that's an easier solution than pushing us into recession, then having to print money to get us out of it.

Joey: I can give a perfect example of this. I don't know if I talked about this on a previous one, but I have a friend who has a roofing company, and about a year and a half ago, plywood OSB, whatever you wanna call it, the four-foot by eight-foot sheets, it was running around $35.

Josh: Oh, man.

Joey: And then it went up to like $120, $130 within a short period of time, like six months, and then fast forward three months later, it's back down to like $35, and I think it's like 40 something, but it was... The supply chain got disrupted.

Josh: Yeah. Lumber just went up again just recently, so it's just... It's manipulated right now. You've got a lot of participation, and it's gonna be interesting to see where this goes in the future.

Joey: I am shocked at how delicate the national level market can be. About a year ago, I heard... I can't remember the gentleman's name. He's one of these famous economist investors. He's... You would know him. But he was talking about why the housing market was gonna appreciate so much, and he was talking about how after 2008 we so over-corrected by not building...

Josh: Yes.

Joey: That there was this massive glut of people that need to buy a home, back to what you said a little bit ago, and I was like, "What?" And it hit so hard. I mean, it hit... He called it, and said it's gonna continue for a while, and whether... And that's all he's really saying, is you have this massive tailwind of supply will not meet... Demand will far exceed supply, right?

Josh: Yep. Totally agree.

Joey: And then on top of that, you have a supply chain that gets disrupted, so you can't even try to replenish supply fast enough. So all of those factors feel like, "Yeah, don't worry, interest rates are gonna go up, and that's you're not gonna be able to afford as much," but if you are worried that the market's gonna come way back down, there's just no inventory.

Josh: There's just not enough inventory. Yeah. That's where I kinda feel like that's the safety factor, or the safety net in this whole thing, is that the inventory right now has been so depleted, it's gonna take so much time to rebuild that inventory, relative to the demand we currently have. That to see this massive crash, or anything like that, it's just extremely unlikely right now. There's just no signs out there for it.

Joey: How long do you think it would take for signs like that to... I don't know, these are some...

Josh: Well, I think you'd have to have risky loans. Negative amortization loans, balloon payments, people that don't qualify for homes buying homes, I mean, a lot of the stuff we saw in 2006, '7, '8, '9, and '10, alright? All of that was based on really bad mortgage practice, where today, people are buying up 15-year, and 30-year fixed loans, and if they can afford the home today, in theory, if they don't lose their job, they can afford the home tomorrow, so we have some really stable real estate markets as well, even though they feel higher than they were a few years ago in terms of price, because of the supply chain, because of the inventory, because of the demand, because of our population growth, I still think we're probably even slightly undervalued when you reflect all of that.

Joey: When you guys do your market overview, when someone says, "Hey, I want to sell my house, how much should I get for my house... Do you take in those factors, those economic factors? Is it just sales, compared to inventory, or do you use those kinds of factors to come up with the ultimate price to hit the market?

Josh: Oh, no, we factor all of it, man. I mean, it's you gotta look at the national market, what's it doing, interest rates, availability of financing, then you look at the county, what price range are performing, how long... What's the average days on market, what's the buyer demand look like? And then you zoom in to the neighborhood that you're in, and the homes you're competing against, and it's that holistic approach that really gets the value, so... But any case, man, I know we're running up on a hard time, but... Anything else?

Joey: No, I'm... Thank you. What I heard was although interest rates are up, very optimistic on the market, very, very low inventory. If you're thinking about selling, now is a great time to hit the market, and get that spring rush, 'cause we are gonna get an influx of people coming up to Redding when the weather... When the grass, the soccer grass is nice and all that, so...

Josh: It's coming. That's right.

Joey: Thank you, Josh. I appreciate your time, man.

Josh: No, thank you too. I appreciate it.

Recent Posts