Josh Barker Real Estate Podcast #5

🏠💰Home Value Tool➔

Frequently Asked Questions

How much does the interest rate affect buying power?

Typically, for every 1% the 30-year mortgage rate increases, purchasing power is reduced by up to 10%.

How can I increase my buying power?

There are several ways to increase buying power. The first way is to increase monthly income and the second way is to decrease monthly expenses.

What is buying power when buying a house?

Buying power is a person's maximum financial potential for purchasing real estate utilizing conforming means. This factors cash funds available as well as the ability to borrow funds.

Transcription*

The transcription is auto-generated by a program and may not be accurate to the conversation. In order to ensure you get all the information from the video properly, you must watch the video.

Joey: Okay. Now it feels. Now, if I talk about the Ides of March, it feels disingenuine, you know what I mean, not if I repeat everything I said before, but...

Josh: What is it about the Ides of March for you?

Joey: Just, I don't know, I really... Augustus Caesar is one of my all-time...

Josh: Yeah.

Joey: I don't know, historical heroes, just the story, his life and his death. I don't know if a lot of people knows about his death, but to me it's an incredible story of... He found Rome in clay and he left it in marble, and he started Pax Romana, which is over 200 years of peace. So, anyway, and his uncle Julius Caesar set the stage for Augustus, so I don't know, that all... This sticks in my head, yeah.

Josh: This guy was the real. Well, anyway, okay.

Joey: So, it's the middle of March.

Josh: Yes, it is.

Joey: It's the middle of March. Interest rates just went up.

Josh: Yep.

Joey: That was not a shock, I mean they've been telling us for months and months, but there's a lot of stuff going on and interest rates are... It's not just the quarter percent that the feds raised, there are a lot of mechanics in play that interest rates are... What are they this morning if I was gonna get a home loan?

Josh: Just under 5%.

Joey: Which, not long ago they were in the twos, low threes.

Josh: Oh yeah, they were up by 2.8, 2.9 in November.

Joey: And you've been telling us how much even a half a point increase in interest rate, how much that impacts your buying power.

Josh: Yeah, so for every 1% that the interest rate goes up, it has an impact on purchasing power by up to 10%, so...

Joey: Which is huge.

Josh: It's huge. Well, yeah, over the last six months, we've seen basically a 20% hit in purchasing power for the average buyer.

Joey: Which is a major headwind.

Josh: Major headwind.

Joey: It should slow things down a bit. Now we've got a major tailwind, but even that's starting to creep up a little bit with the inventory.

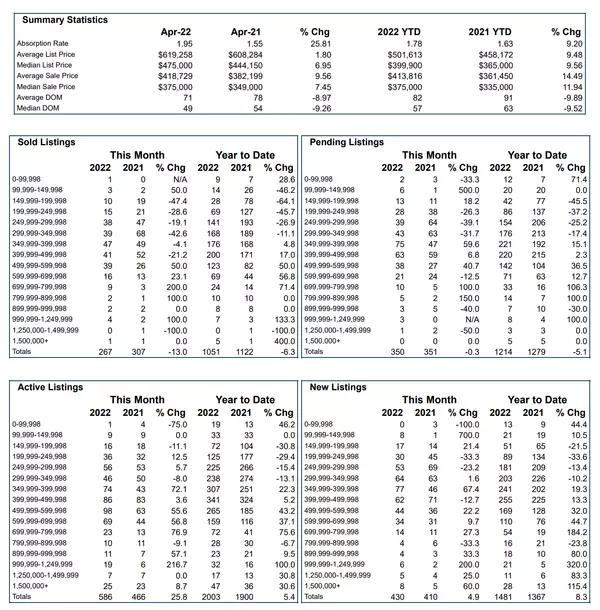

Josh: Yeah, inventory, yeah. So inventory, home inventory on average in the City of Redding wherein the multiple listing service for active residential homes was like 370 two weeks ago. It's averaging about 415, 420 today, so it's slowly... It's still stubborn though, but it's slowly creeping up, but that's why the prices haven't changed because the inventory is still so darn low that we're definitely still in the seller's market. But that purchasing power piece that the buyers are running up against, you know the affordability index, they're running right into that wall right now. And so the next month or two is gonna be pretty telling on what impact that has on the market.

Joey: Especially because these are the big selling months. This is when a lot of the people from out of the area come and check out Redding.

Josh: Yep.

Joey: And I mean these are big sales months for Redding, so there's a lot of... The crystal ball is very cloudy.

Josh: Oh yeah, I mean we're kind of in that chamber of commerce weather right now, right? Between March, April, May and June 'til it starts to get really hot, and we see a lot of inventory come to market over the next 3-4 months from now. The question will be is that as they come to market, will the buyers come to market with them with the impact of interest rates?

Joey: And there's no report that you can get to go, "Oh yeah, this is how many buyers... " This is just flat out a blank space of you don't know.

Josh: Well, yes and no, 'cause not all price ranges are the same. So I think what the interest rates did yesterday moving up a quarter basis point, which was fully projected and expected, and the corresponding effect being the rates on the mortgage rates are going up, but remember, we also had tapering happening. So the federal reserve right now is reducing the amount of mortgage backed securities that they're purchasing while they're raising interest rates, and so you have the shrinking up of availability of credit and you also have rates going up. And so we're waiting to see that private market step in and start buying these mortgages. If they don't, then you're gonna start to see even more impacts on that, but not all price ranges are the same, so like our upper end, that's a more discretionary purchase for a buyer, meaning that I might buy a home at 700 or I might buy home at 800, it really depends on what the home has to offer. But a buyer at 300, normally they're buying up to every penny that they qualify for, because it has a significant impact on the type of home they might buy. You know what I mean?

Joey: Yes.

Josh: So when the rates go up, and let's say you were qualified at 400,000 yesterday or six months ago at 400,000, today that same buyer now is qualified approximately 320,000 today, that's a huge impact on purchasing power.

Joey: And other factors that are involved are things like... That we've talked before, the supply chain, just the ability to build a home, being able to replace inventory below 320,000 is very, very difficult around here. Almost impossible.

Josh: Yeah, yeah, I had lunch about three weeks ago with a builder here in town that does quite a few homes, and we were talking about the... Resupplying the lower end part of the market, and it's extremely cost-prohibitive for these builders because the cost of land acquisition, the development cost, they call it the front foot. So curb, gutter, sidewalks, sewer, electrical, all the stuff they have to do just to get a lot ready to be built on, that cost is pretty much fixed whether you build a home that's 3000 square feet or 1400 square feet, that portion of it still costs the same, those roads costed to the same, the lights costed to the same, the hydrants costed to the same, the water lines, the sewer lines, all that stuff, so they're looking at it going, "The larger the home we can build and still sell."

Joey: Try to get profit, try to make some profit.

Josh: Right. The more profitable it's gonna be and so this is where we're running into this issue that, the lower end of the market is just not being able to be resupplied properly, and that's where most people can afford. And you and I have talked about this before, I'm pretty sure, maybe... Maybe on one of the podcasts, I don't know, but if we went back to the building standards of the early 1990s for homes up to 15, 1600 square feet, and we just did that for three years, you would naturally move all of the... Not all of it, but a significant amount of construction would be moved to those smaller homes because the solar wouldn't be required anymore, some of the insulation requirements wouldn't be there, some of the building methods and standards wouldn't necessarily be there, not that the houses would fall down, none of the other houses in the 1990s are falling down today, they're still good homes.

Joey: Absolutely.

Josh: So if we went back to those standards for a period of time, only up for homes up to 1600 square feet, well now you're kind of pushing the market in that direction. So when they talk about, "We have to solve the housing issue," it's like, yeah, but you have to be willing to give something up to do that. You know what I mean?

Joey: Exactly.

Josh: You have to be willing to give up some of the perfect world scenarios that everybody wants to create to allow for some development that way, but these builders right now, they just can't do it.

Joey: Is that... Are those state, county or city requirements or what combination...

Josh: State mostly. It kind of travels down from the state, and they tell the counties, this is what you have to do, and the cities have to comply with this or they lose certain sorts of funding and things like that. It's all about... The state has leverage over local communities when it comes to funding. You know what I mean? So, "If you don't do what we want, we won't give you the money." And that's the big challenge that cities and counties have. And when you get outside of Redding, when you get outside of Shasta County, you think about the State, you think about Los Angeles and San Diego and San Francisco, those costs almost are negligible because real estate is so insanely expensive.

Joey: It's so expensive.

Josh: So they don't see... To them, they're like, "Why would we take out the need for solar and stuff like that?" That doesn't really impact a brand new home in Los Angeles County.

Joey: No.

Josh: And so they don't get it, so... Yeah. It's... But these people are moving out of LA might wanna move to another secondary market, Redding's certainly one of those. There's a lot of cities like Redding up and down the State, though, that... Instead of leaving the State, they'd stay in the State if they could find affordable housing that meets their needs. They haven't gotten serious about it, in my opinion. If they did, they would have already changed some of that stuff.

Joey: I wonder, because at the same time, you see things like... I think the city of Redding has a big program around these ADUs. They've approved these plans and they've said, "Hey, if you'll build these, they're gonna... " I don't know the exact, but they're gonna waive certain fees, there are certain costs they're gonna minimize. Now, I looked at these ADUs and the designs were pretty intricate. It was like, almost anything the city gave up in fees, it's like you're gonna spend on materials...

Josh: Yeah. So ADUs are like small little houses that you put on your existing property, but that might solve some of the housing. But think about what that means, that means it has to go on a lot that has the room, number one, to put an ADU on it. Number two, you have to have the financial capacity to actually write a check to do that, to have that second or refinance your home or whatever, so that narrows the market a little bit. And then you have, what you just said, which was the cost-benefit of actually building something like that right now because it's still pretty darn expensive. I think it's still a great solution, especially if you have parents or anything else that you wanna have move on to your property, and now the county code and the city code is gonna provide you for you to do that, I think that's great. But is it gonna solve the problem? No, but it's gonna probably contribute a little bit to some of the solution. I think if you wanna solve it though, it goes back to what I'm saying a few minutes ago, change the code for homes up to a certain square footage for the next three years, and have builders having a financial incentive to go that direction with their construction method, 'cause the State talks like they build homes. The last time I checked, the state doesn't build homes.

Joey: No.

Josh: And so what you're asking is the private sector to build homes, and in order to do that, there has to be a cost-benefit because they're not nonprofits, they're for-profit. They have to actually have a reasonable profit for the work they do or they can't do it, doesn't make sense to do it. So, we'll see.

Joey: I think about... So, when you were talking about the segments, different segments are gonna be affected by interest rates. You basically said the lower segment where people are financing to the most that they can.

Josh: Yep.

Joey: Versus somebody buying a $800,000 house, it's... So now they can only buy a $760,000 house, something like that. It's just not quite... It doesn't impact the same. So if you start... You're basically gonna pull first-time buyers, you think about people that buy at that lower end, you're pulling them out, and what you're gonna do is you're gonna make sure they're renters, because what's gonna happen is the investors, the people with money are gonna go, "Oh, okay, well, I can put in a cash offer. I didn't really care about interest rates." And so they're gonna... You wonder how much they'll back-fill in that purchase, 'cause that'll have an effect on the market as well.

Josh: It will. It's... Well, right now, what you were looking at is that affordability index. As rates move up, there's a percentage of the buying market that falls off all together. They can no longer participate because what they do qualify for with rates going up, there's no product available on the market for them to purchase as a result. So, as rates go up, we're automatically losing these people, they're automatically falling off the purchasing side of this whole equation, right?

Joey: Yes.

Josh: Then you have people that are still in the market, but the type of home that they're purchasing starts to change. In Redding, California, and a lot of people won't know our market directly, but if you take a neighborhood, let's say it's a $600,000 neighborhood. And it's a popular neighborhood, a lot of people wanna be in it, let's say you were qualified there six months ago. Well, now, because the rates went up, you can't buy in the neighborhood anymore. Now, you're gonna be purchasing in a neighborhood that's a little bit less, maybe a $500,000 neighborhood now. And so now you literally have to move to a different neighborhood because you can't afford the one that you are qualified in before, and so that's what's gonna happen in the middle market.

Josh: That upper end, again, the discretionary piece there is that a lot of people that buy homes at 800 to a million dollars, they could buy it for a million or they could buy it for 800. That part of it doesn't affect them as much. It's just which home meets their needs the most. And so as rates are moving up, it doesn't have as much of an impact as it does in the other two examples I just gave you. And that's the challenge. And so, if these folks move into the rental situation, and now we have more and more people have to move into rental properties, as a result, 'cause they can't buy, if you have not a lot of rental properties available and you have a higher demand for rental property, what happens to the rents?

Joey: Yeah, the rents go up.

Josh: They go up.

Joey: Yeah.

Josh: Right? And so I was talking to an investor out of LA about this just the other day, they represent a large fund with a lot of investments in it, and they say what they're dealing with is what they call cap compression, meaning that their cap rates are really low. And they can't get the values out of these properties that they want for selling them. And they have some investors in those pools that, at some point they need to sell these properties. The only way to get out of that is they're gonna have to raise rents. And so I think you're gonna probably see the next year to two years, you're gonna see rents actually going up from some of these things that are going on. We have to solve the inventory issue. Bottomline, we have to get more homes out there on the market. We have to stabilize pricing. We have to get it to where people can actually get into homes. We're gonna have a serious problem.

Joey: So besides lowering the requirements to build a home, what are some other things that can be done to help replace that inventory?

Josh: Yeah. Conversations. I told our sales team about this, probably at the beginning of the month, I just said the number one issue, I think, or the number one thing that agent real estate companies can do to get involved in this problem is to have conversations with consumers. If we start talking with buyers and sellers about the benefits of owning a home or selling a home and moving on with your life to the next home, we could start to free up some of this inventory because if more property owners decided to bring their homes to the market, you'd have more buyers, then have the benefit of choosing different homes. And now you can start to create additional transactions which otherwise wouldn't exist, and we have to get this whole train moving again is really what we're talking about.

Josh: And it starts with conversations. We have to get out there in the community. Talk to people, talk about the benefits. Hey, you're thinking about moving into a larger home, why wait? What's the point of waiting? If life is short, life is precious, do you wanna spend your time in this home or would you rather spend your time in the ideal home? Either way, you're gonna spend time somewhere, and so having conversations like that.

Joey: It's like trying to time... People that try to time the stock market or something like that. When I hear these conversations, everyone's like, "Well, the interest rates are gonna do this, and then inventory is gonna do that." And you can't time that. You don't know what's gonna happen. We can see in the short term the feds have said we're gonna raise interest rates, we're slowing down the buying the market, but how far would that go and how long an affect that has. So what I heard was, if you want to do something, then do it now, versus trying to time the market and say, "Oh, well, I know next spring this is gonna happen. Or next summer that's gonna happen." You have no idea what's gonna happen.

Josh: No. And this, when we do this podcast we're jumping onto a lot of different topics. For an investor, timing is pretty important. You know what I mean? You gotta know when to buy and what to buy and how to buy and all those things, but for regular mom-and-pop homeowners, it's kinda like a scale. So you've got on one side of it you have the dollars and cents, making a good financial investment, that's one side of the scale. But the other one is, this is my life, what's gonna make our family enjoy this the most? Bedrooms and baths and square footage and location, and you know, having a home versus not having a home, and so this is the kind of the emotional component. And so whenever you're looking at a homeowner buying something, it's the scale that has an impact on which way you go and what decisions you make. So it's not always about money when it's your home, you know what I mean? It has this emotional component.

Josh: I'll give you a perfect example. My wife and I, in 2005, 2006, we felt the market was about to change. So we sold our primary residence and we actually sold off a lot of our investments, and we moved into a friend of mine's rental that was on the river. And our thought was "Hey, honey, let's just sit here, we'll let the market make some adjustments, and then once it's done doing that, we'll go back in and either build a home or buy a home." And so we did that, we moved into a friend's rental, and the market did what it did, we all know it started to go down. And we could have been wrong in that, but we just thought we were probably right.

Josh: And then what happened was, is that I was in there for like a year. Loving life, watching the market going down. I'm not participating in the market at this moment, so I'm realizing, "Hey, I'm gonna be able to go back in and buy all this stuff here, pennies on the dollar." And my wife comes to me and she says, "Hey Josh, I got a question for you, when do we get to get our new house?" "What are you talking about? The market's still going down, there's no reason to go. This is crazy, we're saving money right now by not doing anything at all." And my wife looks at me and she says, "Well, let me ask you a question. What is the happiness of your family worth to you?" And I was like, "Guess we're gonna go get a house." And so I decided to go build a house because I figured that was where the best value was at that moment, we're still actually in that house, but that was me looking at the scale and going, "Yeah, the numbers make sense to not do this, but my wife's got a good point. Happiness and the family is more important. So we're pulling the trigger."

Joey: I think we're talking about, when I heard you talk, was the difference between someone talking about their primary residence and somebody talking about using real estate as an investment vehicle.

Josh: Yeah.

Joey: You know what I mean? This is numbers. And this is... Don't try to time it if you want a bigger home. If you look at the real estate markets, like the stock market where it has these dips, but it's always climbing.

Josh: It's climbing.

Joey: So it's trying to time those dips.

Josh: If you're in a home and it goes down in value or you're in a home and it goes up in value, if you're in a home, you're gonna receive it either way, so if you're in this house and it's gonna go up in value over time, and the house you buy is gonna go up over time, where do you wanna spend your time? The ideal home while it's going up in value or this home? And the same thing is true unfortunately when it goes down. The only way out of that is if you remove yourself from the market all together and move into that rental situation that I just gave you.

Joey: But I use a car sales term, I wanna sell for retail and buy for wholesale.

Josh: Everybody does.

Joey: Come on. You know what I mean? You give me retail for mine, I'll give you wholesale for yours. Right?

Josh: And you can do that, but you have to be a pretty savvy investor because there's one thing that you can't be tied to, the outcome. Okay? Meaning that you can't fall in love with something if you're an investor, it has to stay on the black and white side of the equation, 'cause as soon as you bring the emotional component in, you stop making the right decisions on this, right?

Joey: Good call. S3: So if you're gonna move into a home, it's really hard to just see that as a black and white thing. Not that you can't do it, we've done it a few times early in our life where we bought a house fully, intentionally, didn't like it, but knew that we were just gonna fix it up and eventually sell it, move into the bigger home. So we can do that, but not everybody's doing that.

Joey: No.

Josh: You know, so you gotta make a decision and really gotta look at that scale, what's more important.

Joey: And so to shift to investors, so people that are thinking about should I release inventory I have? What are some options for them? 'Cause if you sell right now, what do you put it into, where you gonna put that money?

Josh: That's hard. Yeah, so what you can do is you can sell your property and you don't wanna pay the taxes, that's usually the biggest issue. If you've owned a rental for a while, you have the depreciation that you've probably taken off that property during that time that you have to recapture, and then you have either a short-term, if you have it less than a year or long-term, if you've had it more than year of capital gains. And capital gains is both at the federal level and at the state level. So folks, when they go to sell a rental property, if they don't exchange, there's probably going to be a significant taxable event that's going to take place. And so I'll give you an example: If you had a property, and let's just use round numbers, a property that's worth $200,000. And let's say I've owned it for 10 years, so I've depreciated it for 10 years. And let's say that I own it. You know, I bought it for a 100,000 now it's worth 200,000. Okay?

Joey: Okay.

Josh: So I've got about 100,000 of actual profit there too. When I go to sell that property, I get to deduct the fees for selling it. And then I get to, you know, take the acquisition cost. And then you add in depreciation that you've already taken. So I don't wanna complicate this conversation, but let's just say that you have a profit when that's all said and done, 75,000 of profit that now is taxable. Now I have my long term capital gain, depending on your tax brackets. That'll impact this a little bit, but let's just say for a round number it's 35% on 75 grand. Right? I don't know what the exact number is on that, but...

Joey: About 23,000.

Josh: Okay. Somewhere in there. Right. So let's just say you have maybe 50 grand left over now that I get to go invest when and I go sell this property. Right? Which, okay, it's something. And let's go, you put it in the market at 3% or 4% somewhere, I don't know, somewhere. So that's kind of what people could look at as an option. There's other options that are out there too though, where like you can go into, what's called like a DST. It's like a Delaware statutory trust. It's a situation where you take your sale and you exchange into this company. And then you avoid having to pay any capital gains at that time. And so now you have that full profit of a 100,000. That's still getting you maybe 3- 4% return. Does that make sense?

Joey: So what is the DST, does it hold other real estates? Is it real estate to real estate?

Josh: Yeah, they're like a fund, a big one, and you have to be a qualified investor for that, meaning that you have to have a net worth of a million dollars or more, and then also, or at least an income of 200,000 for an individual. I think it's like 300,000 if you're married or something. So it's something, you know, anybody on this would have to just check it out. But these are new things that are becoming available. These are instruments that are becoming available where you can actually sell a rental property. And now you can take the... Exchange it then into a DST. And these are companies that own large, large... That own large amounts of real estate. And then they, you know, they run the performance, it's publicly traded stuff. So it's not like, you know, you're not selling it to your cousin Vinny or anything like that.

Josh: These are legitimate companies and they have to show you performance and everything else. And then, you know, their returns are, you know, 3-4%. You get the appreciation side of it over time. And normally your exits anywhere from, you know, five years on the short end to maybe 10 years on the long end, depending on what you're doing. But the point in this conversation is, is that if I did that, if I exchanged, I get to keep that full 100,000 a profit working for me. If I were to not exchange well, then I might only have about 50,000 right? To go and invest to have working for me.

Joey: Exactly.

Josh: And that's the difference between those two. And then, you know, then there's the normal exchange, which is, you know, you gotta find another property and exchange into it.

Joey: Now both of those are probably like just tax-deferred. Right? Meaning you don't have to pay taxes now. So you're effectively getting a 0% interest loan from the government, 'cause they're like, okay, you owe us 25,000 taxes, but we're gonna wait, you know, wait. And so you just keep going with it, like you said, 10 years.

Josh: Yeah.

Joey: So they've... And you're earning 3-4% on the money that you would've had to have given the government.

Josh: Right.

Joey: So it's kinda like a zero-interest loan. I mean, when you it's... You know?

Josh: Yeah. But there is one caveat to it.

Joey: Okay. There's always a caveat, Josh.

Josh: It's true, let's say you're a married couple and we have that investment and I pass away, now I get to... Now that cost basis gets reset. And so it creates this kind of interesting situation where you get to avoid some of the taxes, because now that depreciation that you already took when it gets reset, the cost basis gets reset. You almost get to start the depreciation piece over again. So, I mean, I'm not the expert on this stuff. I don't want to claim to be. So anybody listening to this, go talk to a CPA about what I'm saying right now because they'll take you in the weeds much deeper than I want to. But it's, but yeah, there's some reasons why people continue to exchange up into bigger and bigger properties because what they're doing essentially is they're moving out that depreciation, they're increasing the amount of write-offs they get as a result of doing that. So there's a strategy behind it.

Joey: There was a couple of builders years ago, I remember when I first got into real estate and they were building homes and then they kept 1031 up and both of them independent of each other, 1031 into they built apartment complexes. And there's a lot of rules and intricacies here. But the idea was that they just kept deferring the taxes. You know, this is all legal, where they just kept rolling the money over and over and over until finally they rolled it into an entity that they said, "Well, I'll never sell that."

Josh: Right.

Joey: And effectively what had happened was instead of all those times paying taxes.

Josh: Yeah.

Joey: They got a 0% effective interest loan...

Josh: Yeah.

Joey: From the government to build really large units. And I think one of them did like five fourplexes 'cause there's... 'Cause what we're talking about is 1031 exchanges.

Josh: Yeah.

Joey: And then the DST is another option and there's, I think there's are some more options. You and I were talking about some.

Josh: Like tenants in common and stuff like that. Of which I'm not a huge fan of, because of the cash, you know, the capital call that you might have on it. And remember like tenants in common is another option, and those were very popular over the last 10, 15 years. But the problem with them is, is that let's say you have a group of like 5-7 people that are in this tenant in common. Right? You pretty much all have to agree on whatever it needs to be done. So let's say that the roof is failing and the choice is to patch it or replace it, right? Well, you gotta get on the same page on that. And so a lot of times tenant in common turn into these deferred maintenance nightmares.

Joey: Yeah.

Josh: Because you can't get anybody to agree to take care of the property the way it needs to be taken care of. And so it starts to go down in condition, therefore in value, and you know, at the end of the day, it's tough. You know, that's a big reason why my wife and I, we've never had tenants in common with anybody because we don't like to have somebody else dictating what we can and can't do with our property. But like those DSTs, you're signing off, I mean you might as well kind of have the idea that you're giving it away to a mutual fund, so to speak, 'cause you're not, you don't have any management over it. You have decision making over it.

Josh: They give you pro-forma based on what they think the returns will be on your investment, and then what the potential for appreciation is over time and you're done... That's it. And that's not for everybody either. And in exchange, you've gotta... You're under a time clock, right? So you exchange... It's gonna go fast, you're gonna have to sell your property, you got 45 days to identify, and you have a total of 180 days to close, so you gotta move forward with it so...

Joey: I think one of the big X factors in all of this right now is because I was just talking to a buddy of mine who has a... He was... There is a project in town that is an approved, I think apartment complex and the land, and he was talking about wanting to sell what he had and move into that project, but the problem was the ability to finish that project in a time that would meet those 1031, so normally... He might have been able to pull that off but with supply chains the way things are it's... You know what, we're sitting here... There's a lot of options. A lot of cloudiness.

Josh: Oh yeah, it's brutal man. I would never recommend trying to do construction and exchange again. I've done it before, but we didn't... It was in 2007 on Hempstead. My wife and I did a reverse exchange where we sold some buildings, we bought a raw piece of property and built two buildings on it in six months.

Joey: Impressive.

Josh: On a reverse exchange.

Joey: Impressive.

Josh: Well, I feel bad for the exchange company because he was the one that had to write the checks on all the draws. It turned into this logistical nightmare for the Exchange Company, I can't believe the work they did for us. It was incredible. We still refer to them to this day because I feel like I still owe them for all that work they did. They were just incredible. But that's... The time constraints that are involved in construction on exchanges is just... It's so many elements now that are out of your control, I would have never have done what I did actually, if I would have known what I was gonna have to go through to do it, I would never have done it again. It's scary.

Joey: And certainly not in today's market where supply chains are still fluctuating, things are still a little bit...

Josh: Yeah.

Joey: But the bottom line is, you have options.

Josh: You do.

Joey: There are plenty of options out there.

Josh: Yep, absolutely. So to sum it up, essentially, the Federal Reserve, did raise the interest rate by a quarter percent yesterday, corresponding effect was rates went up, and we're probably looking at rates right below 5% now, and it might go up higher than that. The Fed also though, did say that they expected to maybe raise rates again multiple times this year, so we're looking at a higher rate environment. The buyers that are affected that we talked about as rates go up purchasing power is affected, so we're gonna be seeing some of that play out, but in any case, for our listeners today, we're just trying to be consistent with giving you guys some good content and... Any other thoughts on that, Joey?

Joey: No, thank you so much, Josh. There's a lot going on and people have questions and hopefully, we were able to answer some of those questions. You were able to answer some of those questions for them. And thank you for that.

Josh: Yeah, thank you.

Recent Posts