Josh Barker Real Estate Podcast Episode #3

🏠💰Home Value Tool➔

Frequently Asked Questions

Is the housing market going to crash in 2022?

The housing market in the first quarter of 2022 appears stable. The headwind of potentially higher interest rates may be taken over slightly by the tailwinds of low inventory. Next, the amount of investor speculation in the Shasta County market is relatively low. Lastly, the dominant type of financing in the local market is 15 to 30 year fixed loans. It is unlikely that the real estate market will experience a crash in 2022.

Are financing rates going up?

Mortgage interest rates increased an average of 1/2 percent between December 15, 2021, and January 15, 2022. The federal reserve has reported that they intend to raise interest rates 3 times in 2022 which could translate into higher mortgage interest rates in 2022.

Is it worth fixing your home before selling it?

The majority of home sellers that chose to fix a home up before selling state that the number one improvements they plan to perform before selling are flooring and paint updates.

Transcription*

The transcription is auto-generated by a program and may not be accurate to the conversation. In order to ensure you get all the information from the video properly, you must watch the video.

Joey: So I'm here with Josh Barker again, again, right? Episode number three.

Josh: Yeah.

Joey: We were just off-camera, we were talking about the market and some of the headwinds and tailwinds that are in play right now in January of 2022...

Josh: Yeah.

Joey: And what kind of effect that's gonna have over the next few months? Because real estate is very seasonal...

Josh: It is.

Joey: It always slows down in the wintertime, it picks up in the spring...

Josh: Yup.

Joey: But it's picking up a little faster than it normally does, right? You were telling me that it's a little faster than this time last year or the year before.

Josh: It is, yeah, we're getting more calls right now in January than we typically get in January in previous years. So, I think there's that pent-up seller demand that we had talked about before, where you had people.Obviously, because of the pandemic that decided to stay put. You had the eviction moratorium that was, you know, keeping the inventory down and even the foreclosure moratorium, and so, now you're starting to see people say, Okay, we're done, we've waited as long as we can wait, it's time to get moving on. And so, we're starting to see a pretty significant uptick in the number of appointments that we're going on, that people wanna sell their homes, yeah.

Joey: And there's a couple of factors that we were talking about that we thought, you know, people should know about sellers or potential sellers should know about, like number one is, the feds have said that they wanna raise interest rates three times in 2022, right?

Josh: Yeah. Yeah.

Joey: And as we learned in our first episode, that's a headwind.

Josh: Yup.

Joey: It's not an immediate headwind, meaning they raise interest rates on a Friday and Monday, the market comes down, but it is one of those things that it reduces the buyer's ability to how much they can spend.

Josh: Yup.

Joey: And so thus, it has an effect, the headwind on the seller price, right?

Josh: Yeah, you're right, absolutely.

Joey: Now, the big question would be, is how big of a headwind? You've said like a half a percent reduces, was it like 5%?

Josh: Yeah, for every 1%, the interest rate goes up, it could have an impact on purchasing power by about 10%. Yeah.

Joey: Okay, so that's one, but we do have quite a few people moving here. Redding is still very affordable when you put it on the scale of California.

Josh: Sure.

Joey: So you've got these headwinds and tailwinds hitting each other, and we're not sure how much they're gonna affect, but interest rates are a headwind, so wanting to go to market before interest rates increase, I mean, theoretically that would...

Josh: Yeah.

Joey: Garner you more for your home, right?

Josh: Yeah, and for this video for some of our listeners right now, one of the more significant things that's been happening over the last month since our last podcast was interest rates did jump. So, pretty much starting around December 14th, 15th, we started to see rates start to creep up. And a big part of that is the interest rates haven't even gone up yet from the Federal Reserve standpoint, they haven't raised those yet, but the reason why is because the Federal Reserve at the same time that they're saying they're gonna raise interest rates, they've also said they wanna reduce the purchases of bonds. And so, by them tapering and purchasing fewer bonds, that's actually moving the interest rate up now, so just that activity alone has moved the interest rate up one-half a percent on average over the last 30 days.

Josh: And so for those who were already in the purchasing process, they probably realized real quick from their lenders, hopefully, that they needed to lock their loans, but also for refinances, if you didn't lock your loan, you're probably not as happy with that rate today, 'cause the rates did move up. Now, all of that's happened prior to the interest rates that are supposed to go up, the first one will likely be in March. Federal Reserve said, they wanna raise the rates three times in 2022. I just read another report the other day that said maybe four times. They're still trying to deal with that massive inflation, that the whole economy is dealing with. So the first rate increase would likely be in March, and then each quarter thereafter, you could expect that it's a strong consideration by the Fed. I think that first one in March is for sure. And so when they do it, it's every time they raise, it's usually about a quarter percent, which translates right into an increase of almost a quarter percent of the mortgage market too.

Joey: So, you don't know what's exactly how the market is gonna go, but the idea is that if you know a headwind is coming and you are thinking about selling, now might be a great time to reach out, find out, Hey, what is my home worth in the current market, and see if that sits well with you.

Josh: Yes. I mean, look at that and also 'cause we have clients that are thinking about doing some remodeling too before they actually come to market. And actually, that's more concerning for me than anything because in some cases, homes do need to be updated a little bit before they go to market, there's plenty of instances where I would say that's a good move, but there's a lot of instances where it's not. And right now what we know the interest rates are highly likely to be going up significantly in the short term if it took you 90 days or 120 days or 180 days to finish a remodel on the home, and your goal would be because it would help you get more money for your house, if the interest rate goes up half a percent during that time then whatever you thought you were gonna get in the benefit on the market, it might be eroded away by the rise of the interest rates.

Josh: And so, I think people need to slow down and just really have a professional come out, meet with them and really walk through that scenario and see what is the right thing to do? You know, if you're siting on a house right now with pink countertops, then yeah, maybe you're gonna have to do a little bit of an update, but if you got white tile, you might wanna let that go.

Joey: Yeah, because you know it's kind of a cliche, but the 90-day project becomes a 180-day project real quick.

Josh: Yeah.

Joey: And the 180 days is six months, now we're talking July, that's two potential Fed rate increases, 'cause you see it quarterly, so that's March and that would probably put us in June.

Josh: Yup.

Joey: So you just kinda have to think about that and it's not just the contractors, we're short on labor, but also supply chains. We just remodeled our house.

Josh: Yeah.

Joey: And we were shocked. It's just every little, Oh yeah, we don't have that title, or no, that paint's gonna be... And you know, has this rippling, this domino effect where you're trying to line up these contractors, you're trying to get materials, and it just doesn't. It's always kinda been that way. I think that's always been a thing, like, what contractor comes in under budget and ahead of schedule, it almost never happens.

Josh: Hard, yeah.

Joey: And no dig on them, we're in an unusual time. So, before you dump $30,000, $40,000, $50,000 grand into a home, 'cause you think you're gonna make so much more, you need to talk to a professional and say, hey, if I put $50,000 grand into this, would I guarantee to get more than $50,000 grand?

Josh: Yup.

Joey: And even then if it's... You put $50,000 grand in something to get $60,000 grand out, you're putting a lot of money in play for...

Josh: A lot of money in play. And it's a pretty big risk, right?

Joey: Yeah, big risk.

Josh: So, I think you're right. I think it's pretty wise, I think to slow down, and a lot of people think that you gotta get your home ready before you have the agent come out and I just don't think that would be wise right now. I think it would be better to have the agent come out and then evaluate what your options are, do we do an upgrade? Do we not do an upgrade? How soon do we bring it to the market? Understanding that there are some significant factors that might have an impact on the market going forward. I mean, I don't wanna paint a doom and gloom though, I mean, that the...

Joey: No, I don't think it is.

Josh: No, I don't either. Most of the reports that I'm reading right now are averaging around 4% and 5% appreciation this year, so you know, we still have a low inventory market that we're currently in, and so, it's highly likely that interest rate or that the... Even with interest rates going up the pricing of homes will still likely go up a little bit, just it's very unlikely it'll be like it was over the last 18 months.

Joey: Well, that's like the hottest 18 months the markets have ever seen, I mean, that's kinda crazy.

Josh: Yeah, yeah, definitely one of the hottest.

Joey: Yeah.

Josh: So, something to be just I would just slow down and have somebody come out, take a look at it, get a good feel for what your options are, do what you have to do, but try to avoid doing anything that might be discretionary in nature.

Joey: Yeah, and one of the big X factors is how many people are gonna move to Redding? 'Cause, that's driving a lot of the purchases. Like you said before, we don't have a high investor. When the market wasn't good in the early 2000s, it was because there was this large percentage of homeowners who were investors.

Josh: Yup.

Joey: Secondary and tertiary homes.

Josh: Yup.

Joey: Now, we're not seeing that. I think you said it was around 10%, which is very small.

Josh: Yeah, yeah, and it's a tough number to track too, right? So, all the lenders that I talk to, that do a lot of the origination for obviously for the financing up here, and a lot of the brokers that I speak with on a regular basis, I mean, we're pretty much all on the same page, that it's about 10% or less of all purchases in the county right now, or what we call investor, meaning non-owner-occupied kind of investments. So, to your question initially of that, what does demand looks like? It's not gonna be what it was. I mean, 18 months ago, when the pandemic first hit, you had a whole lot of people that were disrupted, so they could work from home, they were looking for other places to maybe live, because they could live anywhere and work from any location, and so, we started attracting some people from Sacramento, the Bay Area and Southern California, and I think that was a great thing obviously for us, but it probably gave us a little bit more additional demand than we may have otherwise had, obviously.

Josh: I do think it's helped us though, because I think we've become more popular and a little bit more known to the rest of the state, so even though our volume of people moving in from out of the area might go down a little bit here in the next year compared to 18 months ago, or over the last 18 months, I still think it'll be higher than it would have been if it had not been a pandemic. You know what that means? 'Cause, we're becoming known now. I mean, I would say that in a lot of circles, Redding is being brought up now.

Joey: And going back to that whole headwind, tailwind, that's a huge tailwind. People moving into the area, that's...

Josh: Low inventory relative to demand is definitely a tailwind.

Joey: Yeah.

Josh: Right? So you've got the headwind of interest rates, right? Rates going up is a headwind that we have to overcome. You have the tailwind of low inventory relative to demand that's pushing pricing up, and where those two intersect and reconcile is where you're either gonna have an appreciation or market flatter going down, and I would say the tailwind is still a little stronger than the headwind, but the headwind is getting stronger.

Joey: I would think that the other big questionable headwind/tailwind is you talked about the forbearance market, it's still very, very cloudy on how that's gonna get handled because there were quite a few people that were not paying their mortgage, they were getting the moratorium, and we're not really seeing how quickly their...

Josh: Process to enter into the market.

Joey: Yeah. Are they getting refinanced through their banks, are they saying, You know what, I bought this house five years ago, I'm sitting on a ton of equity in five years, we still don't know what that's gonna look like, and that's gonna be potentially either a large tailwind, meaning, nope, the forbearance is very, very low or it's gonna be a headwind, meaning, suddenly there's a lot of inventory that hits the market all at once.

Josh: Yeah, I don't know if it's gonna hit all at once. I think it's gonna spread out. I mean, to get to the point on that. I think we definitely have some distressed properties that are in the market still that a lot of it was created because of the pandemic. You had the disruption in employment and the ability to pay, and maybe even for some landlords, it was a disruption in their cash flow, and their rentals and 'cause their tenants weren't paying and they, therefore, weren't able to make their payments on their mortgages. So, either they were gonna have a loan modification provided by their bank or refinanced based on a couple of options that may have been available. Or they're gonna sell the property in one manner or another. So, right now, you can assume that a lot of those folks do have equity, even if it's thin equity, they probably still have some equity.

Josh: So I think you could see those properties if they were to get ahead of it and do it quickly, they could expect to see those homes sell on the market as a normal sale, which would be great. If you're behind on your mortgage and you can't find a way to modify the loan or refinance it, then gosh, consider selling it and putting a little bit of cash in your pocket.

Joey: Versus losing it.

Josh: Versus losing it. Absolutely. And so, I think we're gonna see some of that. I don't know if it's gonna all come at the exact same time, but right now we're sitting in just under 600 homes for sale, and a healthy market's like about 1000 to 1100 based on current sales volume, so we need a lot of inventory this spring. And I'm hopeful that that happens, but right now it appears that we're gonna see more inventory this year than we did last year, for sure.

Joey: Are there any other factors right now that sellers should be... The variables that they should be weighing. We talked about interest rates coming, a potential increase in inventory, do a forbearance market, should you be putting money in the home? Are you really gonna get that money back? Are you gonna hit the market? The two interest rates. Is there another big factor that a seller should be thinking about right now?

Josh: Well, the spring rush is what comes to mind. So, normally we see our inventories really start to grow significantly by late March, early April, you start to see the inventory grow, and we call that our spring rush. And if a client or a seller has the ability to get to the market prior to the spring rush, what they could possibly enjoy is less competition and a buyer who's trying with some urgency to get into a home before the interest rates get pushed up too much. And so, there's some opportunity, I think that sits there for those who can come to the market a little bit earlier. But timing-wise, it's all relative too though, so if you're buying and selling in the same market, let's say the market gets a little softer in June, okay? If you're selling your home in a little softer market, but you're also buying in the same market, but you're buying is a little softer as well, so it kinda works its way out. But if you wanted to sell and liquidate an asset or move and if you do it before the spring rush, I think you're probably gonna enjoy a little bit of a shorter market time. Maybe a little bit higher buyer demand, because rates are being pushed and buyers wanna take advantage of the lower rate while they can. So I think there's an opportunity in that.

Joey: Is there anything that you would think... 'Cause you talked about in 2022, the numbers look like maybe about a 4% to 5%, and that's what we should see as far as to increase in value across the board.

Josh: Yeah, they did, like the Mortgage Bankers Association, National Association of Realtors. There's like a collection of different... It's like five or six companies that all came and gave their opinion on what the appreciation was gonna look like this year, in the average between 4% and 6%, that was the total range that it was.

Joey: For the entire market, and that's the.

Josh: Yeah.

Joey: People gotta understand that there are segments within the market.

Josh: There is.

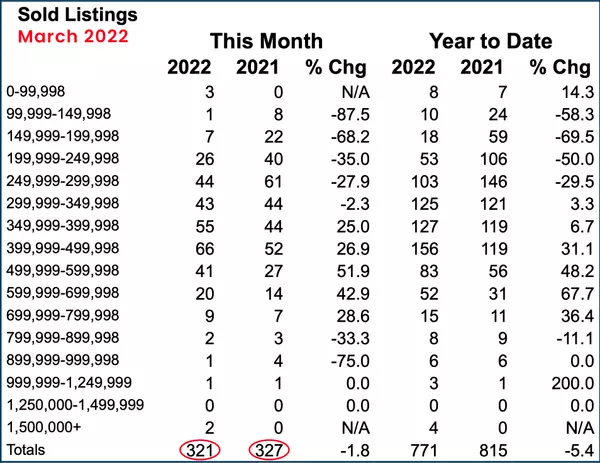

Joey: And so there's gonna be segments that probably see a much greater than that, and there might even be segments that are either stale or there's a glut of inventory or something, or there's just not a lot of buyers. Because one of the things I think is when I looked at the segments that sold, definitely the middle range climbs at a much higher than the high range.

Josh: It does.

Joey: Because there's such a limited number of buyers.

Josh: That's right.

Joey: And so if you are sitting at the higher end of the range, you may not... I don't think you felt that would be a good report, maybe for one of our future podcasts, if I don't know if we could get that, but kinda show like appreciation by segments.

Josh: Yeah, we could probably take a sub-division and say, Okay, in this subdivision it's improved. The average selling prices went from here to here over the last 12 months, and then take a higher price subdivision and compare from this year over the last year. You could identify that. We've done it a few times actually. We used to do it like with Coral Ridge, which is a subdivision here in town, and it's a lower price point, and then we put it up against White Hawk, which is a higher price point.

Joey: Oh, yeah. One of the highest.

Josh: And one of the higher ones in the market. Yeah. And so when we compared the two, we saw that Coral Ridge did appreciate at a much more significant number than White Hawk did. And to your point, it was because the buyer demand and the lower price range was higher and it pushed appreciation in that market faster. And I think we're gonna see something like that again too, where who's gonna supply the market first is really what's interesting in this, right? So, as we go on these appointments right now, we're trying to figure out, okay, who's coming to the market at a higher number? Is it the lower end that's coming in faster, or is it the upper end that's coming in faster?

Josh: And we haven't seen a ton of upper end yet. And I think that's coming, I think they're gonna be here in the spring. I think that's when you're gonna start to see the higher-end inventory really start to hit the market by country properties, for example. Those tend to sell for a little bit of a higher price, but they all start coming to the market as soon as those trees start to bloom. As soon as there's a little bit of green on those trees, that's when you start to see a country property come to the market at a high volume, and it's because it's with yellow flowers and trees are budding out and then everything looks great and country property starts to hit the market, and that has a saturation effect on what's available to purchase.

Joey: And I wonder what the ratio of... 'Cause we talked about. You talked about the ideal inventory being 1000 to 1100. I wonder what that is per segment too because you don't see a lot of home selling in that higher... So you kinda wanna beat the I guess, it depends on when the buyer hits the market too.

Josh: Well, it's this year too, I mean, last 18 months, we saw more homes sell in the upper end than we've seen in a long time, a really long time. And the question is, can we do it again in 2022? Are we gonna see some of those upper-end properties selling at the same volume that they did last year? And I suspect probably not, not at the same volume, but there will still be some more sales than I think we were experiencing three or four years ago. You know, again, Redding's beginning to become a little bit more popular, things are... Gosh, I'm just blown away by some of the positive conversations that I'm hearing from friends of mine that live in the Bay Area in Southern California, and when they talk about Redding, it's a pretty optimistic vibe right now.

Joey: Well, we've talked about a few things, there's several projects that are going on, construction that's going on. The airport is expanding.

Josh: Yup.

Joey: It's got three airlines, they keep adding flights, direct flights. And talking to Megan of Shasta EDC, she was talking about how they would like to add more and more flights...

Josh: Right.

Joey: Major different markets, Denver, Portland, Phoenix, all these different things, and it just depends on volume...

Josh: Yeah, you need demand too, right?

Joey: Yeah.

Josh: You gotta have people who wanna fly there.

Joey: Exactly. So there's a lot of factors that... That's... I've been bullish on Redding for a while now...

Josh: Yeah.

Joey: It's been several years.

Josh: Yeah.

Joey: And just seeing the rest of the state and seeing how congested they are. I just went to Sacramento a couple of weeks ago, and was just blown away...

Josh: Oh, yeah.

Joey: Like, how congested Roseville and Citrus Heights and Rockland... You know, I used to think of those areas and they were the out... They are... It's bumper to bumper. And I think why would... It's just... To live so tight.

Josh: If you don't have to drive into work every day, you know, at a facility somewhere, which obviously would have made a big impact on where you could live. If you have flexibility though, oh, man, I think Redding's got some really good appealing things to it. And you and I know what those are, but like the trail systems are incredible and they're focused on improving the trail systems. I'm watching people walking around everywhere. We've had like Chamber of Commerce fly there the last week and a half where it's just been like, "You gotta be kidding me. This is January and I'm enjoying these days that we're getting to enjoy." It's fantastic.

Joey: On a side note, my aunt lives in... I was raised in Alaska. My aunt lives in Palmer, Alaska, and a couple of weeks ago she called and it was, I think, five degrees and they were having hurricane-level winds that they'd never had.

Josh: Right.

Joey: And she was just complaining to me. And I said, "Oh, I know exactly how you feel. I went walking today, it was 54, but it felt like 52. It really did. I had to put a scarf on and she hung up. But my wife and I went walking this weekend, it was like these harsh Redding winters, they're just...

Josh: Oh, I know. Yeah.

Joey: I think it broke 70... Really truly broke 70 degrees in January, so this weather will bring people as well.

Josh: Oh, that's great man, yeah.

Joey: So the bottom line is, there are several factors every year, there's constantly headwinds and tailwinds. We know for sure some of the headwinds coming and a potential increase in forbearance inventory on interest rates going up at least once, and they've chimed three times. So we know those headwinds are coming. The big question mark is, the tailwinds, how strong will they be? Will they overcome the headwinds? If so, by how much? And when you should bring your property to market?

Josh: Yup.

Joey: You know? And so, the bottom line is, get involved with an expert, call somebody on Josh Barker real estate on the team. Have them come out, assess whether or not you should be putting $50,000 grand into that? Like, are you really gonna get that money back?

Josh: Yeah.

Joey: And are you going to get to market in time to maybe get that spring... What was the term you used?

Josh: Spring rush.

Joey: The spring rush.

Josh: Yeah.

Joey: So all that's coming and it's speculation, but that's how that works.

Josh: Yeah, it is, and I think you're exactly right. I would just echo that our inventories are still hovering around that 600. For those of you who are shopping for a home right now just be encouraged, there's gonna be some more opportunities, I think, going into the spring, so that's a good thing. But as that inventory grows, it's gonna have a little bit more pressure on homeowners. Market times are gonna go a little longer, the amount of buyer demand might go down a little bit. Keep in mind that interest rates right now, they've already bumped to half a percent in the last 30 days. So if you weren't paying attention, you may have missed that. And that's before the Federal Reserve starts raising rates. Like we said, it's probably gonna start raising in March and we're going each quarter thereafter if they stay with the plan they've announced, subject to change, and if you're thinking about doing a remodel, like you said, yeah, be careful. It could take longer and be more money than you thought. So, really evaluate what can you get today, and is that sufficient to reach the goals you have versus taking this risk of putting a massive amount of improvements into your home, only to find out that because of the market dynamics changing, you didn't gain much from it. So, those are the things I think we just gotta watch out for.

Joey: Well, if you think about this, this is kinda like a mindset of, "Okay, can you time the market perfectly?" Right? So if you time the market perfectly, congratulations, you're awesome. Okay, you did. Then you have to look if you do not time it perfectly one direction versus the other direction, if you say, "Well, I sold my house. If I would have just waited a few more months I would have got a few thousand versus I waited too long and there was. The interest rates went up, there was a glut of inventory and suddenly I... " You know what I mean? You didn't lose money, you didn't have it on the front, but you did lose money that you didn't get on the other side.

Josh: Yeah. No, and we're obviously probably in the ninth inning for significant appreciation in this cycle. I don't think anybody's really arguing with that, I mean we could still see some appreciation because our inventories are still low. And until we start to re-supply that existing inventory or the replenished inventory to a meaningful level, we're probably not gonna see too much of a negative in terms of appreciation. But it's just not the thing to echo would be, it's not gonna be a significant loss over the last 18 months. If that's what your expectation of real estate is, maybe let down this year.

Joey: Do you... I hate to hit you with a question out of left field here, but do you have any idea on how long homes are sitting in inventory now versus maybe when they were at the height of the market?

Josh: Yeah, we were sitting right around 98 days from start to finish. And then that's a 45-day Escrow, so it's just over a 45-day market period on average.

Joey: Which is not that long.

Josh: It's not that long.

Joey: It goes fast.

Josh: It is, yeah. Over the last 20 years, we remember when it was like 180 days on average before homes sold, it was brutal. But homes that are priced accurately out the gate, in price ranges where people typically shop, you could expect them to sell in as early as two weeks, in some cases with competing offers. So, still a great market to sell in. I certainly don't wanna downplay that.

Joey: I think that'd be great next time we meet, if we can show some numbers on the segments, how fast a segment moves, what kind of appreciation a segment saw, I think that will clear things up. Because I think a lot of people see the market as the market, right?

Josh: Right.

Joey: Everything went up 10%.

Josh: Some percent. Yeah, and it's not.

Joey: And it always takes 90 days and you go, if the higher end probably sits a little bit longer than the lower end, and it didn't appreciate percentage-wise as much as the lower end. And so that has a big burn. So if you're sitting at the higher end now might be a time to get a professional involved and find out so that you can get those numbers and you can see what kind of... How long should you be on the inventory, how much inventory... Because inventory is your competition.

Josh: Yeah.

Joey: That's the other big thing is, there isn't a lot of competition at that space, but it's relevant or it's relative to how much or how many buyers there are.

Josh: Oh yeah. Well, it's supply and demand economics 101. It's... If you follow that principle you probably will be going in the right direction, you know, for sure. So, yeah.

Joey: So the bottom line is, give Josh and his team a call, they can come out assess, no obligation, let you know, get a professional's opinion on what you can and should do.

Josh: Absolutely, yeah, and I would totally recommend that. I mean, most people are gonna interview two or three agents, and I think it's wise to do that. Compare services, compare strategies, and make a decision at that point you think works best for you.

Joey: 'Cause it's not all the same.

Josh: It's not all the same.

Joey: The marketing plan really, really matters, right?

Josh: It does. It does.

Joey: The marketing plan should reflect what the market looks like, right? I know you do a lot of marketing outside of the area.

Josh: We do.

Joey: Because there's a lot of buyers coming from outside of the area. And so, the marketing plan should probably extend past the county line.

Josh: Absolutely. No, I totally agree with that.

Joey: Well, thank you for your time, Josh. Until next time.

Josh: Thank you.

Joey: If anybody has any questions, they can give you a call.

Josh: Sounds great, Joey, thank you.

Joey: Thank you, Josh.

Recent Posts